Fundamental briefing: The risk-on feel in emerging markets extending further on a dovish Fed or recovery in oil prices alongside foreign inflows into equities and bonds being sustained. Although Korean currency has won in the recent past, KRW is one of the biggest potential losers from continued JPY and CNY weakness, which we expect. South Korea has the highest export correlation and lowest export complementarity with Japan and China.

Technical glimpse: USDKRW hits multi-month lows

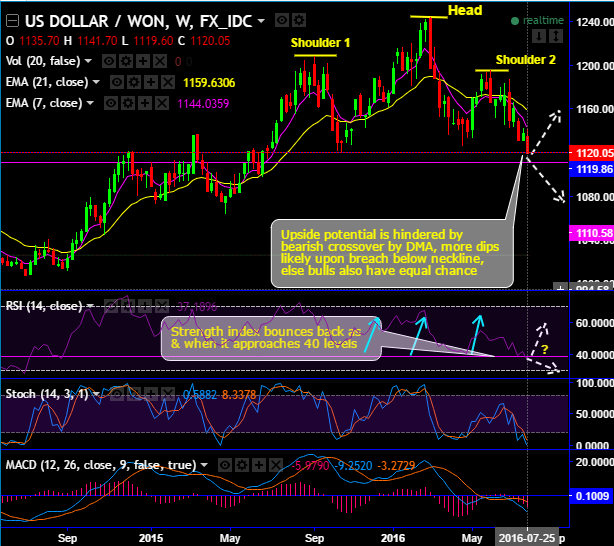

From a technical perspective, USDKRW is trading near multi-month lows at 1119.60.

The pair has also formed a “head and shoulder” pattern on the weekly chart with the head at 1244.30, shoulder 1 at 1208.60 and with the shoulder 2 at 1196.10 levels.

A decisive break below 1120 & 1110 (the neckline of a distinct head and shoulders pattern) would be a bearish signal for USDKRW, opening the door for further KRW strength. Otherwise, we foresee equal chances of a sharp bounce back towards 1175 levels.

To substantiate the effects of "head and shoulder" pattern, on daily charts, bears have managed to evidence more bearish candles such as the gap down that signifies the weakness to prolong further.

However, RSI on the contrary at 40 levels has bounced back several times in the recent history and prices have spiked accordingly. Well, reiterating above pivot points of 1120 and 1110 would be closely watched on a closing basis.

One can expect higher targets up to 1175 as long as the current level holds on, otherwise, the long-term bearish trend is quite certain, bears can even drag up to 1099 levels where we can see next strong support.