ATM IVs of this exotic Latin American pair of 1m expiries are spiking crazily above 19%, while the vega flashes higher positive number that signifies OTC sentiments are more concerned about upside risks ahead of the US elections.

Vega is generally larger in options which have the longer time until expiry, and it falls as the option approaches expiry. This is because an increase in IV is more beneficial for a longer term option than for an option that would expire in shorter tenors. The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM.

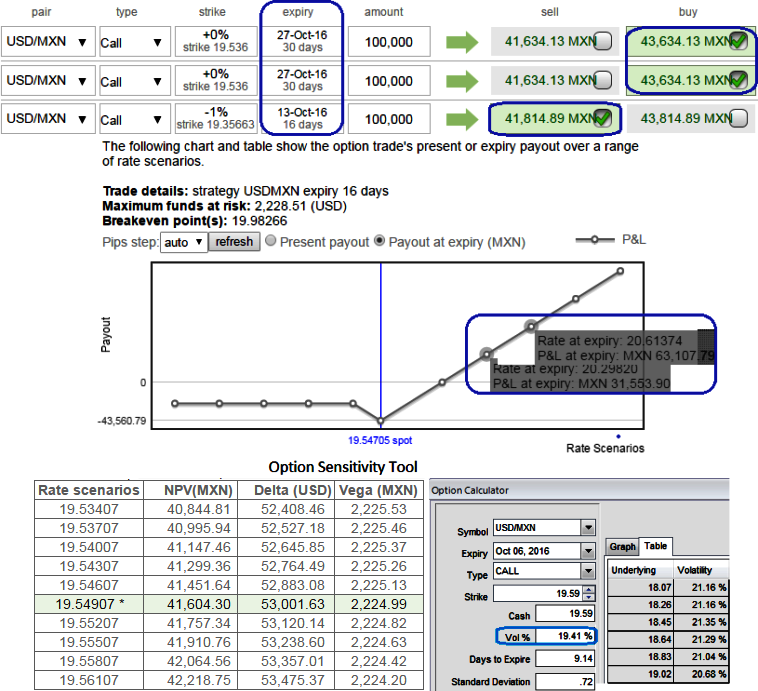

ATM IVs of this timeframe are spiking crazily at 19.41% and standard deviation at 0.72.

We think, although Mexican currency is attempting to recover in its prices, the above stated US election news and Fed’s hiking expectations during Christmas in addition, engulf with the uncertainties.

The robust uptrend and higher IVs would mean the market thinks the price has huge potential for large movement in the upward direction.

Hence, as shown in the diagram, hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) with comparatively shorter expiry in the ratio of 2:1. Thereby, short term dips would be taken care by shorts and long vega calls capitalize on IVs to hedge upside risks.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cashflows.

The lower strike short calls seems little risky but because IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes