We remain MW RUB, but are bearishly biased, holding USDRUB call spreads. YTD the ruble has been the strongest performer in EM FX, with a spot around +7.5% stronger (vs USD).

However, in the assessment of risks from the prevailing levels are skewed to the downside, given expensive valuations, a non-conducive technical backdrop, and geopolitical uncertainties.

Accordingly, we hold 26-July-19 USDRUB 67/71 1x1 call spreads, entered at the ending of March.

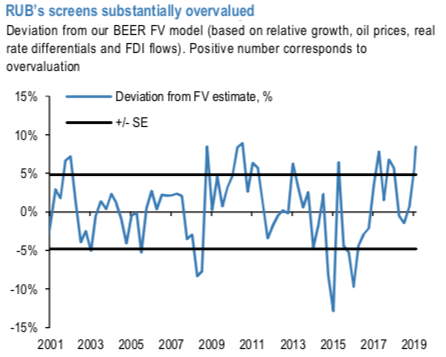

The valuations are one of the most expensive in EM. Following the strong start to the year, RUB screens expensive in our BEER FV model, and is one of the richest in EM.

In the preferred methodology to take the budget rule into account, we use a weighted average of the current oil price (1/3) and the budget rule oil price (2/3). Using this adjustment, RUB’s real effective exchange rate currently screens around 8% overvalued (refer to 1st chart).

The positioning has become somewhat stretched out. Ruble positioning has been steadily rising, with our J.P. Morgan Client survey for April showing an increase to +1.8, the highest level since July-18.

In addition, IMM data suggests a much more extended speculative longs in RUB (refer 2ndchart). This data can be very volatile, but our informal feedback would also indicate outright FX longs have risen.

Finally, geopolitical risks remain a key concern. Geopolitical risks continue to linger, and if were to materialize, could generate bouts of capital outflow pressure. With the budget rule in place, our economist forecasts the CBR to purchase $67bn of FX on behalf of the budget rule in 2019 from the $100bn projected current account surplus. In a way, this does not leave a strong buffer to deal with such potential capital outflow bouts. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR is flashing at 31 (mildly bullish), while the hourly USD spot index was at 34 (mildly bullish) while articulating (at 13:04 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty