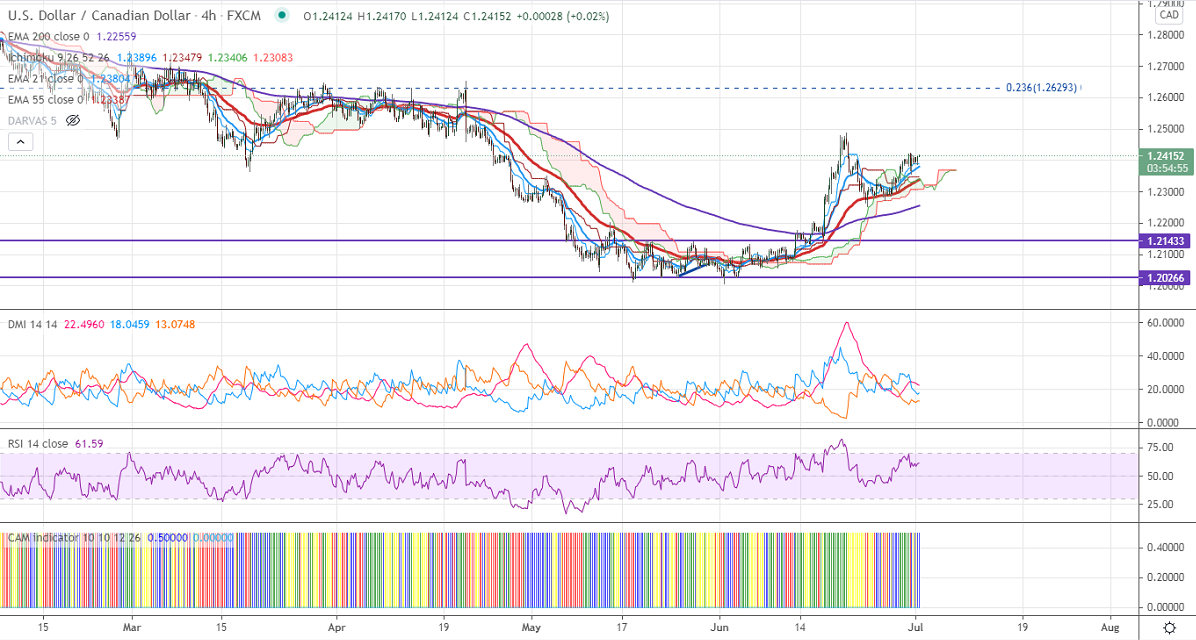

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.23896

Kijun-Sen- 1.23479

Previous week low – 1.2250

June month high- 1.2480

USDCAD's performing well after Fed shifted its rate hike from 2024 to 2023. The pair has gained 2.7% in the month of June. Any surge above 1.2480 confirms s bullish continuation. A Jump till 1.2630 (200- day EMA and 23.6% fib). The surge in delta variant corona is also supporting the US dollar. The pair is declining despite WTI crude oil trade s near a new 52- week high. USDCAD hits an intraday high of 1.24125 and is currently trading around 1.24129.

Trend –Bullish

The near-term resistance is around 1.24210, a breach above targets 1.24800. On the lower side, immediate support stands around 1.2360, violation below will take the pair down to the next level 1.2300/1.2250.

It is good to buy on dips around 1.2400 with SL around 1.2360 for TP of 1.2500.