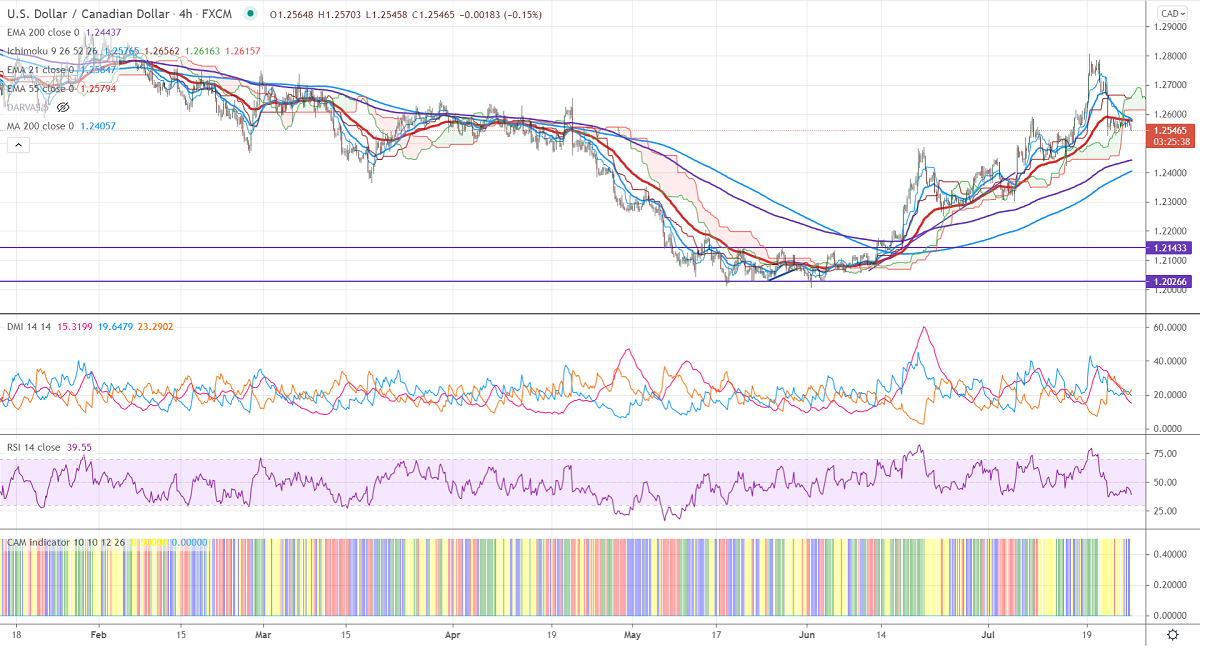

Ichimoku analysis (hourly- Chart)

Tenken-Sen- 1.25780

Kijun-Sen- 1.26032

USDCAD is surging towards 1.26000 on declining crude oil price. The Canadian retail sales declined by -2.1% in May compared to a forecast of 3.0%. The minor sell-off in the US 10-year yield is preventing the pair from further upside. USDCAD hits an intraday low of 1.25566 and currently trading around 1.25569.

WTI crude oil regained after 2- 3 weeks of losses on tight supply. The overall trend is bullish as long as support $65 holds.

Technically, the pair faces near-term resistance at 1.2600. Any indicative break above will take till 1.2660/1.2700/1.2765/1.2800/1.2835. The significant support is around 1.2520; an indicative violation below will take to the 1.2480/1.2435.

Indicator (Hourly chart)

CAM indicator – Bullish

Directional movement index – Bearish

It is good to sell on rallies around 1.2618-20 with SL around 1.2660 for a TP of 1.2520