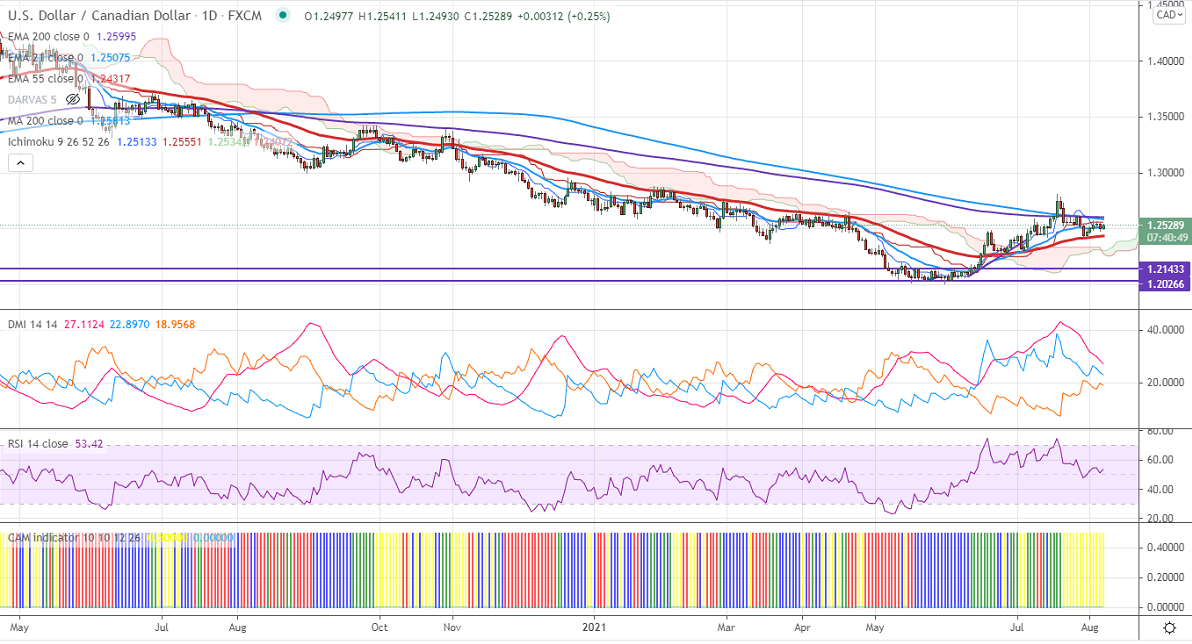

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.25133

Kijun-Sen- 1.25551

The pair surged more than 40 pips after upbeat US jobs data. . The US economy has added 943000 jobs in Jul compared to an estimated 870000. The unemployment came at 5.4% vs the forecast 5.7%. The average hourly earnings jumped to 0.4% above the forecast of 0.3%. The Canadian jobs data came dismal with the addition of 94000 in Jul below the estimated 148000, unemployment jumped to 7.4% v.s 7.5%.

Trend –Bullish

The near-term resistance is around 1.2550, a breach above targets 1.2600/1.2660. On the lower side, immediate support stands around 1.250; violation below will take the pair down to the next level 1.2435/1.2400.

It is good to buy on dips around 1.25200 with SL around 1.2480 for TP of 1.2660.