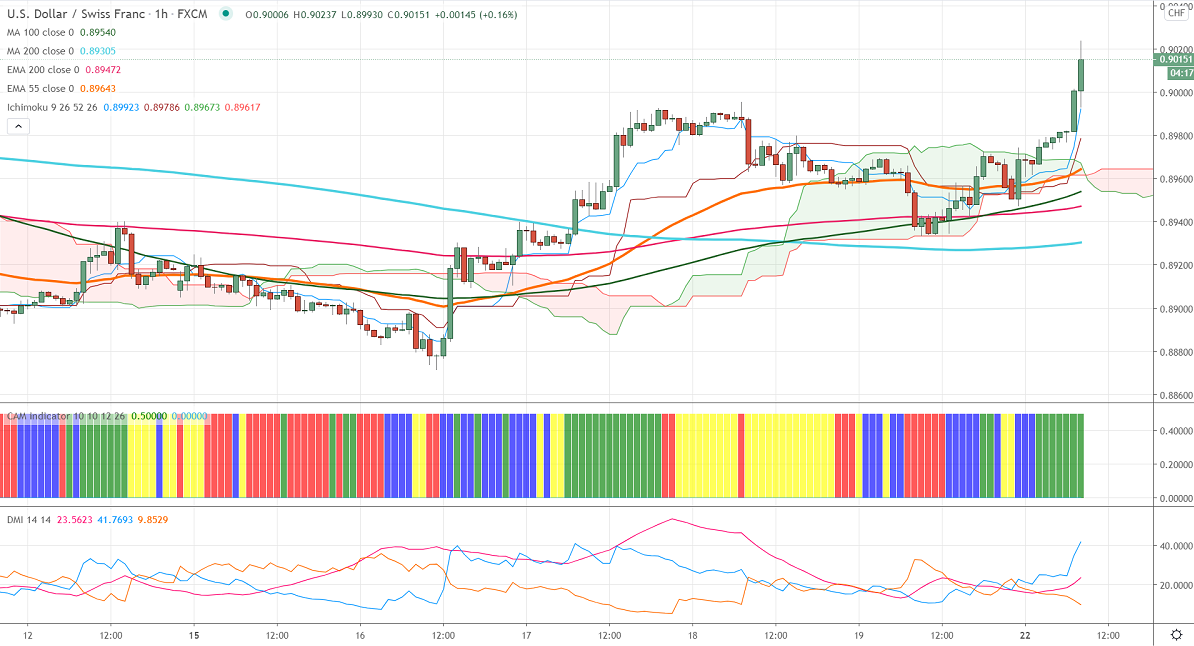

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.89745

Kijun-Sen- 0.89676

USDCHF recovered more than 100 pips from minor bottom 0.88750. The jump in US bond yield is supporting the US dollar at lower levels. The US 10-year bond yield hits a 1.40% fresh year high on more US stimulus hopes. US dollar index is struggling to close below 90 levels, with minor bullishness above 90.60. Markets eye US Fed chairman Powell speech and Conference board Consumer confidence data tomorrow for further direction.

The near-term resistance at 0.9045; any convincing violation above will take to the next level till 0.9080/0.9125. Significant trend reversal only above 0.90450.

On the lower side, significant support stands at 0.8960, any indicative break below targets 0.8930/0.8800/0.8750.

Indicator (1-hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.9000 with SL around 0.8960 for a TP of 0.9010.