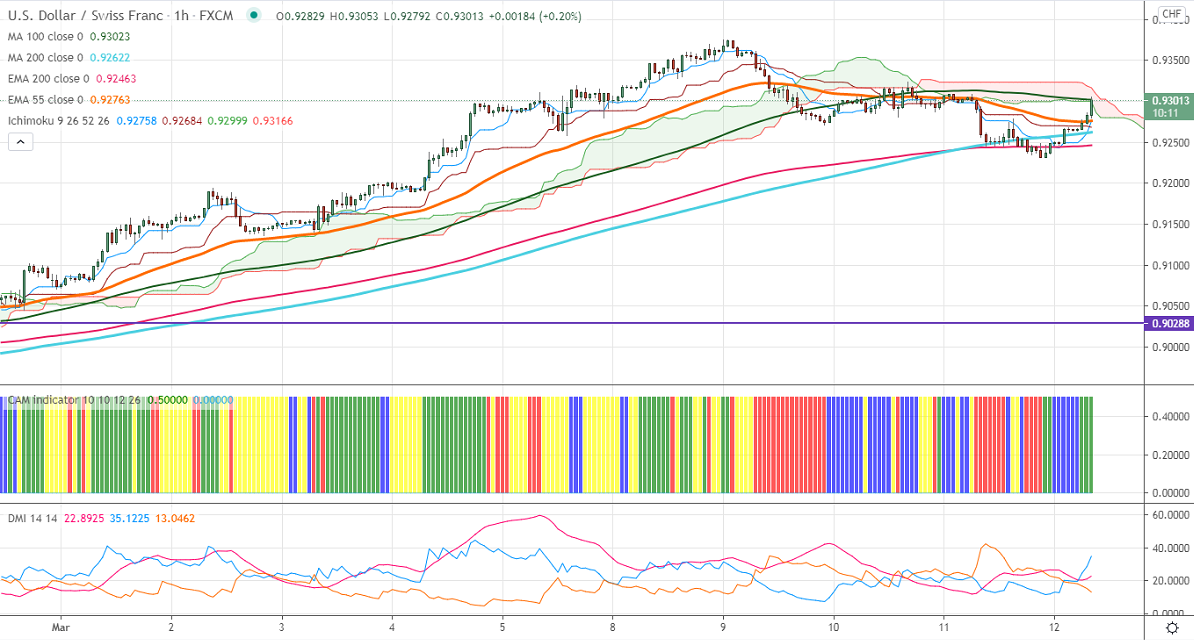

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.92601

Kijun-Sen- 0.92699

USDCHF has recovered a lot after a minor decline below 200- H MA. The pair was one the best performers in this month on surging US 10- year bond yield. The inflation data came at 1.3% YoY compared to a forecast of 1.4%. While CPI ex-food and energy at 0.1% m/m vs 0.2% expected. The US dollar is under pressure and trading below 92 levels. The short-term trend is on the higher side as long as support 0.92250 holds. The pair hits an intraday low of 0.93064 and is currently trading around 0.93021.

The pair is facing significant resistance at 0.9320, this confirms intraday bullishness. A jump till 0.9365/0.9380. On the lower side, significant support stands at 0.9260, any indicative break below targets 0.9220/0.91440.

Ichimoku Analysis- The pair is trading above Kijun-Sen and Tenken-Sen. This is slightly below the Ichimoku cloud.

Indicator (Hourly chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.9278-80 with SL around 0.9220 for a TP of 0.9375.