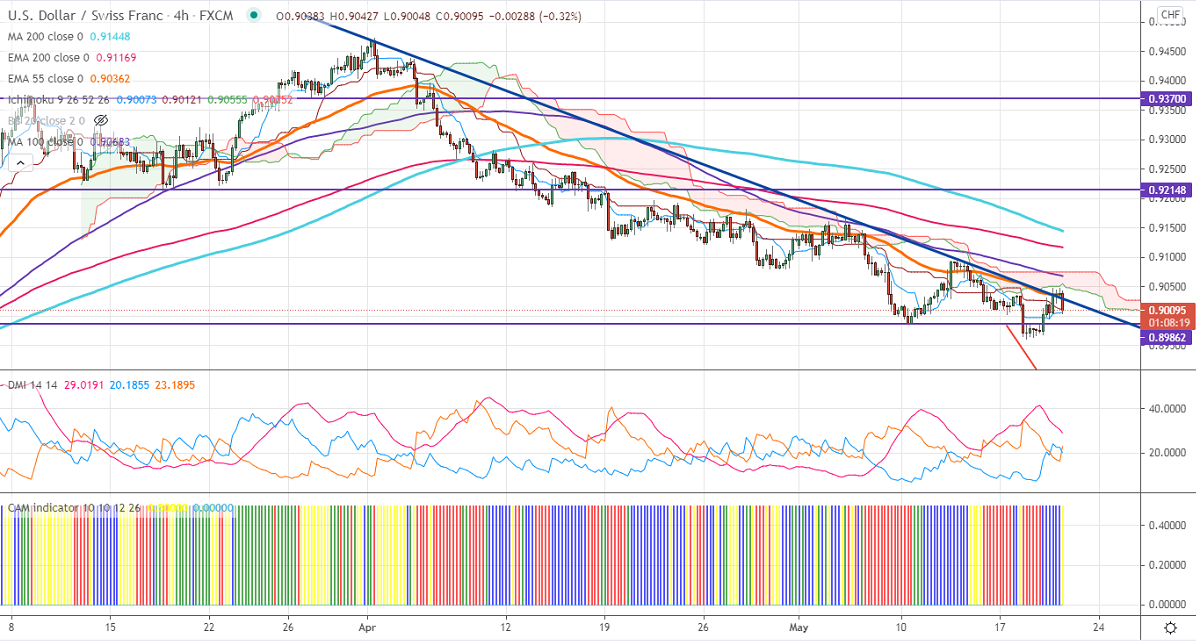

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.90054

Kijun-Sen- 0.90121

USDCHF is trading flat in a narrow range between 0.89603 and 0.90473 for the past two days. The pair was one of the worst performers in the past month and continues to trade weak this month. The minutes for the FOMC meeting in Apr showed that some of the members are slightly hawkish and discussed QE tapering. "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the minutes said. The intraday trend is weak as long as resistance 0.9045 holds. The US dollar jumped more than 50 pips from minor bottom 89.69. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Neutral

The pair is holding well below 4- H Kijun-Sen, Tenken-Sen, and cloud. The near-term support is around 0.8960. Any close below 0.8960 will take the pair to next level to 0.8900/0.8835. On the higher side, near-term resistance is around 0.9050. Any breach above targets 0.90925/0.9150.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.9018-20 with SL around 0.9050 for a TP of 0.8900.