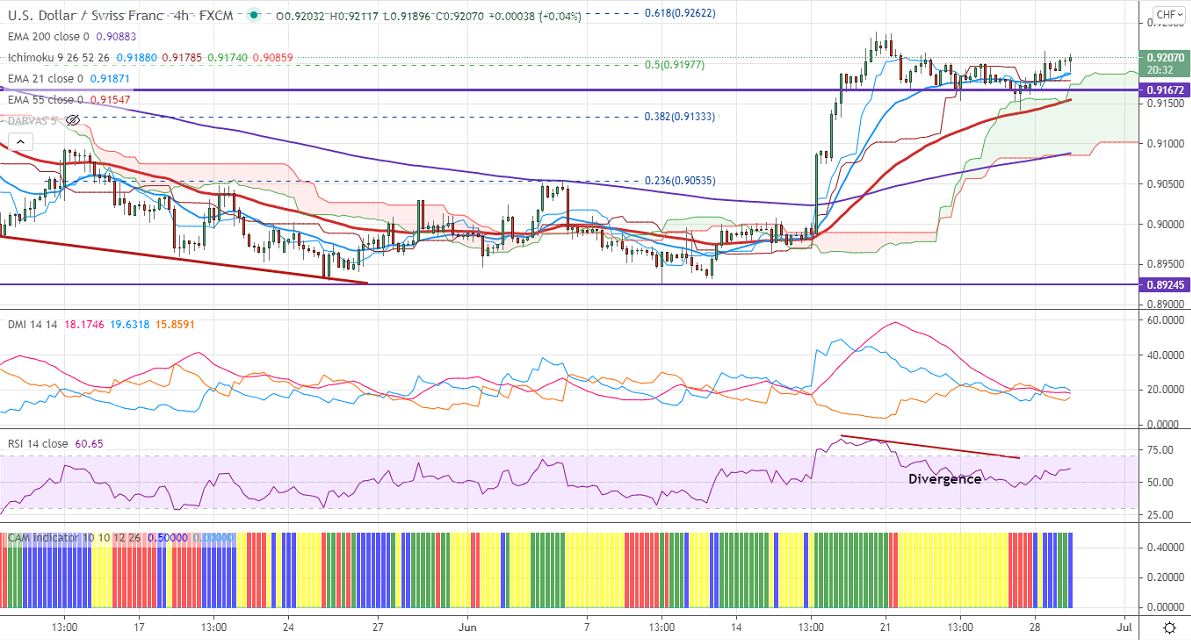

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.91880

Kijun-Sen- 0.91785

USDCHF recovered more than 50 pips on board-based US dollar buying. The US dollar index is hovering near 92 levels; any breach above 92.50 confirms further bullishness. The upbeat inflation data and dovish comments from Fed are supporting the US dollar at lower levels. The decline of more than 5% in US 10-year bond yields also pushing DXY higher. The pair hits an intraday low of 0.92117 and is currently trading around 0.92084.

Trend- Bullish

The pair is holding above 4-hour Tenken-Sen, and above the cloud, Kijun-Sen. The near-term resistance is around 0.92370. Any indicative break above 0.9240 confirms a bullish continuation. A jump till 0.9300/0.9360 is possible. On the lower side, near-term support is around 0.9185. Any convincing breach below targets 0.9140/0.9080/0.9050/0.9000. Significant selling will happen only if it breaks 0.8920.

Indicator (4-Hour chart)

CAM indicator –Bullish

Directional movement index –Neutral

It is good to buy on dips around 0.9180 with SL around 0.9140 for a TP of 0.9300.