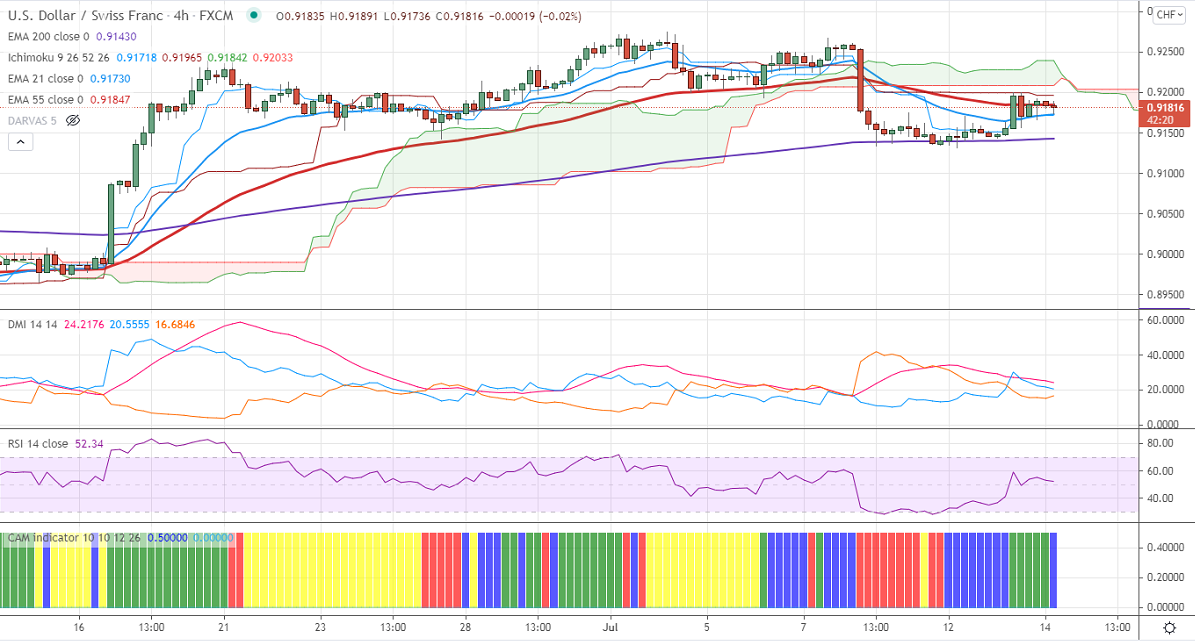

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91718

Kijun-Sen- 0.91956

Previous week High– 0.92676

Previous week low- 0.91330

The pair has shown a minor recovery after upbeat US inflation data. . The US CPI m/m came at 0.9% and 5.4% in June from a year earlier, the highest level since 2008. The overall trend is still bearish as long resistance 0.92750 holds. Markets eye US PPI data today and Fed Chairman Powell speech for further direction. The US 10-year yield recovered more than 15% from a low of 1.25%.

Trend- Neutral

The near-term support is around 0.91219, the breach below will take the pair to 0.9059/0.9000. On the higher side, immediate resistance is around 0.9200. Any convincing breach above targets 0.9238/0.92750.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index –Neutral

It is good to sell on rallies around 0.9180 with SL around 0.9238 for a TP of 0.9050.