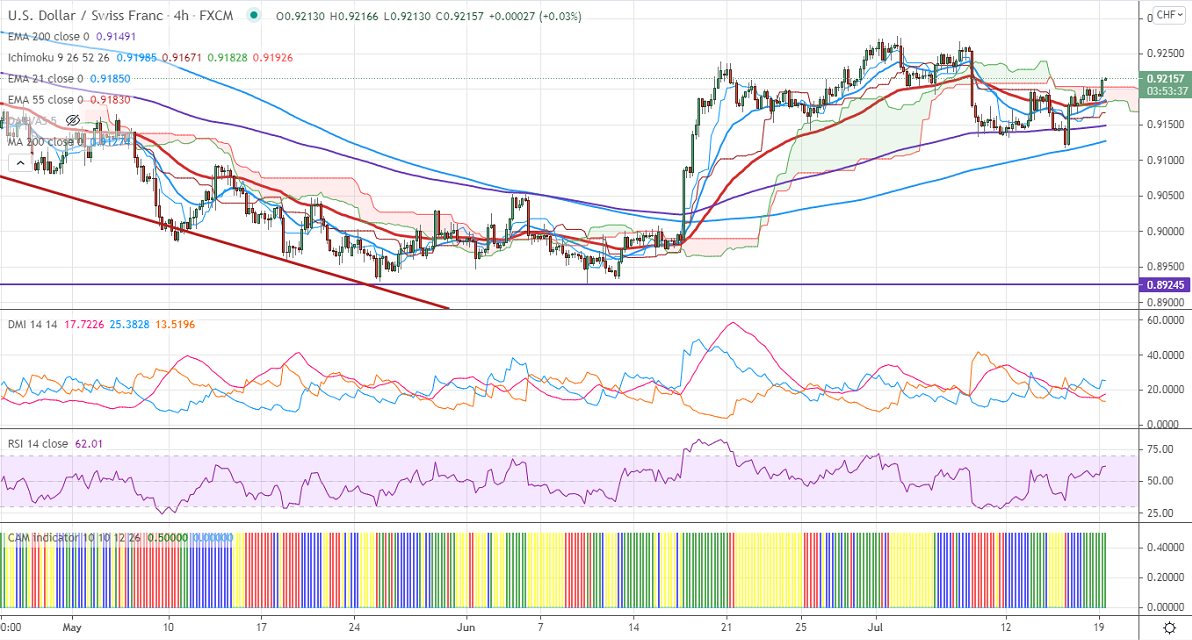

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.91913

Kijun-Sen- 0.91671

Previous week High– 0.92676

Previous week low- 0.91330

The pair has taken support near 200-4H MA and surged more than 50 pips on board-based US dollar buying. The intraday trend is bullish as long as support 0.9150 is intact. But overall bias remains on the downside as long as resistance 0.92750 holds. US retail sales rose 0.6% last month compared to a forecast of -0.4%. The surge in the number of delta corona variants has increased the demand for safe-haven assets.

Trend- Neutral

The near-term support is around 0.9150, the breach below will take the pair to 0.9120/0.9059/0.9000. On the higher side, immediate resistance is around 0.9230. Any convincing breach above targets 0.92750.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.9185-88 with SL around 0.9130 for a TP of 0.9270.