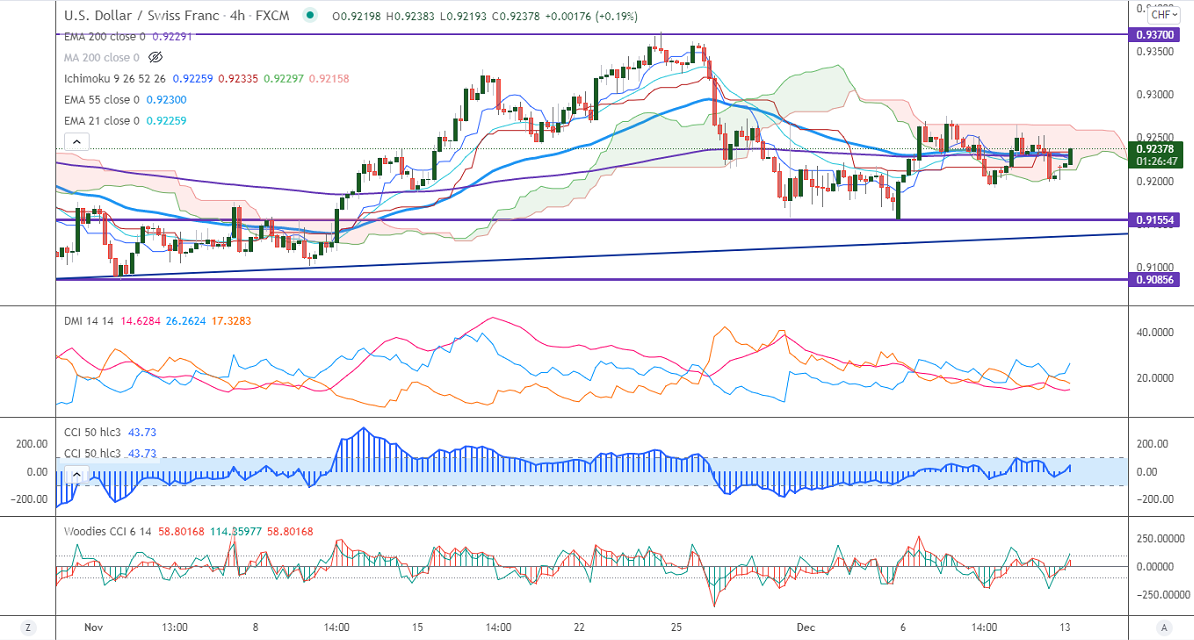

Intraday trend – Neutral

Significant intraday resistance – 0.92755

The pair traded in a narrow range between 0.91954 and 0.92649 for the past three days despite easing Omicron concerns. Markets expected to trade flat ahead of Fed monetary policy meeting. It hits an intraday high of 0.92364 and is currently trading around 0.92348.

Bullish scenario-

The primary levels to Watch – 0.92750. Any convincing surge above confirms intraday bullishness. A jump to 0.9330/0.9380 is possible.

Bearish scenario-

Intraday support – 0.9180. Break below that level will take the pair to the previous week's low 0.91574. Significant trend reversal only if it breaches 0.9150.

Indicators (Daily chart)

Directional movement index – Neutral

CCI (50) - Neutral

It is good to stay away till the further direction