Intraday bias - Bearish

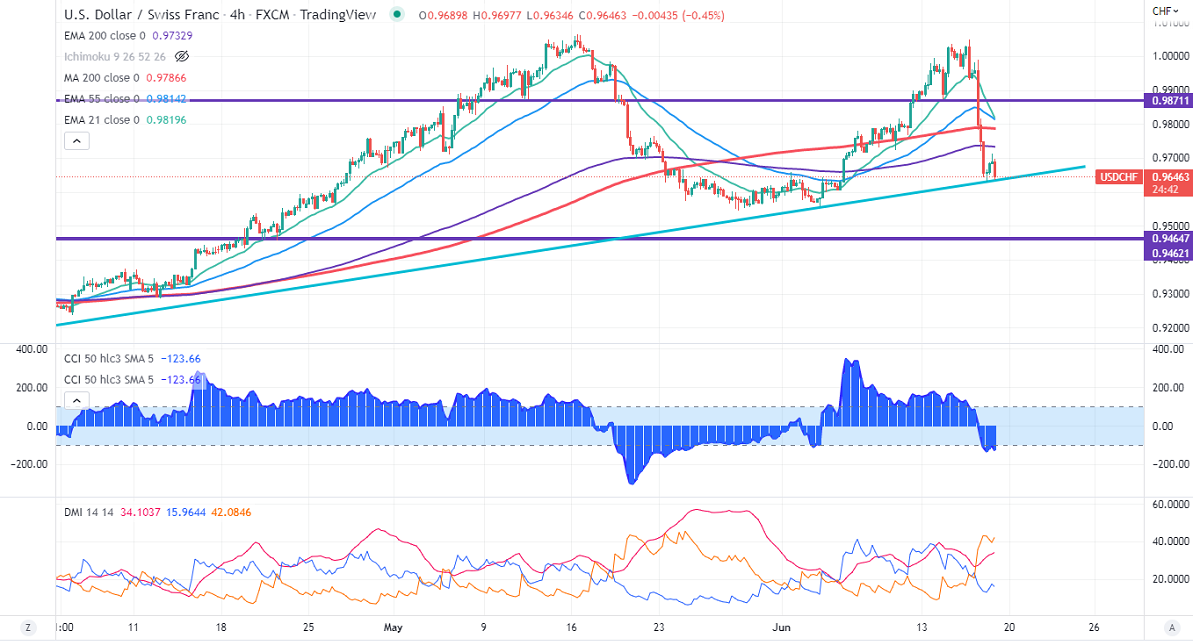

USDCHF declined drastically and lost more than 350 pips after a surprise rate hike by SNB. It hiked rates by 50bpbs and confirmed that the central bank will take necessary actions if inflation surged. Technically in the 4-hour chart, the pair is holding below the short-term (21- and 55 EMA) and long-term moving average of 200 EMA (0.97870). Any close below 0.9600 confirms intraday bearishness. A dip to 0.9550/0.9500 is possible. USDCHF hits an intraday low of 0.96345 and is currently trading around 0.96485.

The near-term resistance is around 0.9720 any breach above targets 0.9780/0.9865.

Indicators (4- Hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to sell on rallies around 0.9660 with SL around 0.9725 for TP of 0.9500S.