The US Federal Reserve delivered another quarter-point increase in interest rates at its December meeting, an outcome that was widely expected. Moreover, the Fed continued to signal that further hikes were warranted, though it lowered its expectations for next year with the ‘dot plot’ now showing two quarter-point increases in 2019 (down from three previously). Meanwhile, early this morning, the Bank of Japan unsurprisingly left policy unchanged with Governor Kuroda suggesting that it was too early to discuss the BoJ exiting from its current ultra-loose monetary policy stance.

OTC update and trade recommendations: Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 109.50 levels so that OTM instruments would expire in-the-money.

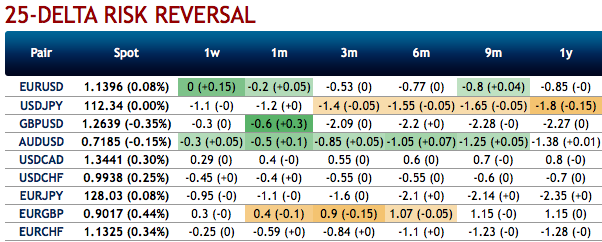

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run. IVs for 2w tenors are on lower side which is good for put option writers, while 2m IVs are on higher side which is good for put holders.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 111.83 levels, we advocate buying a 2M/2w 113.723/109.00 put spread on Fed and BoJ monetary policies (vols 7.52 vs 6.35% choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 82 levels (which is bullish), while hourly USD spot index was at -61 (bearish) while articulating at (09:00 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady