We articulated a high conviction, constructive view for EUR predicated on the robust cyclical lift in the region and the unwinding of distortions to capital flows and EUR valuation from the unconventional monetary policy.

We also stated that EURJPY PPP and FEER valuations are the yen bear’s arch-enemies, but they apply far more to the USDJPY than to the EURJPY, given that the euro, too, is significantly undervalued on a PPP basis. The PIIE puts a FEER-consistent EURJPY rate at 121. More important perhaps than the valuations, however, is our confidence that the ECB is further along the road to policy normalization than the BOJ.

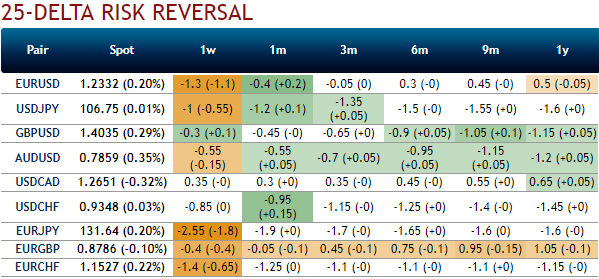

While please be noted that the bearish neutral risk reversals are still indicating bearish risks in longer tenors, while positively skewed IVs of the 3m-1y tenors signify the hedgers’ interests in OTM put strikes. These skews signal underlying spot FX to drop below 126 levels. While glance through above nutshell evidencing risk reversals, although these numbers have been neutral, we can understand the highest hedging sentiments for bearish risks of this pair among G10 FX space. Bearish hedging remains intact.

To substantiate this standpoint, if you observe the technical chart of this pair, the major trend has been rising higher upto 61.8% Fibonacci levels from the lows of 109.205 levels but with struggling momentum. The technical momentum indicators have been substantiating overbought pressures in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Buy 3M EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls for directional traders.

Buy 3m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 40 levels (which is bullish ahead of the data announcements of German and Spanish CPI prints followed by M3 money supply) while articulating (at 06:55 GMT), while hourly JPY spot index was at 138 (highly bullish). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis