As we foresee more bearish potential on this pair huge profits achievable with the strip strategy when EURCAD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

As the bulls could not hold trendline support at 1.4695 levels to claims more dips further. Hence, we could foresee next target at 1.4355 levels towards south.

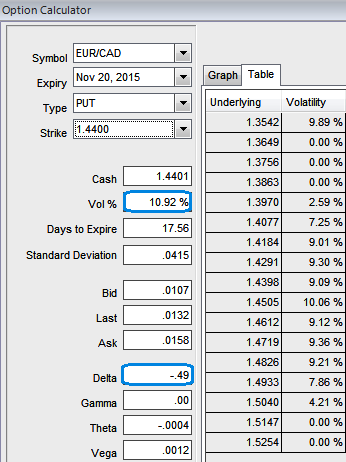

Weights are to be more to cushion downside risks as a result, we recommend holding 15D at-the-money 0.50 delta call and simultaneously hold 2 lot of 1M at-the-money -0.50 delta put options.

The rationale: Any potential downswings should be optimally utilized, so as to participate in that downtrend, weights in the portfolio should be doubled with ATM puts in order to give the leveraging effects. The profitability can be maximized for every shift towards downside and this is not the same on upside.

What makes ATM instrument more productive in our strategy and delta effects: The delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date.

As a result, time decay may have a relevant impact on ATM options. A higher absolute delta value is desirable for an option buyer.

In other markets (equities, commodities), one would buy delta S units of the underlying securities to hedge a short vanilla option position.

But in FX markets, this is equivalent to buying delta 'S' times the foreign notional N. This is equivalent to selling of DS*N *St units of domestic currency.

Please be noted that the absolute value of delta is a number between zero and a discount factor, therefore, 50% is not the center value for the delta range.

Premium-Adjusted Spot Delta: The premium-adjusted spot delta takes care of the correction induced by payment of the premium in foreign currency, which is the amount by which the delta hedge in foreign currency has to be corrected.

ATM have the highest Gamma, Vega, and Theta which means their premium is the most sensitive to moves in either direction. The Delta of ATM options are 50%, which means there is an even likelihood of expiring ITM or OTM.

FxWirePro: Use EUR/CAD ATM spot delta to make option strips more productive

Tuesday, November 3, 2015 10:36 AM UTC

Editor's Picks

- Market Data

Most Popular