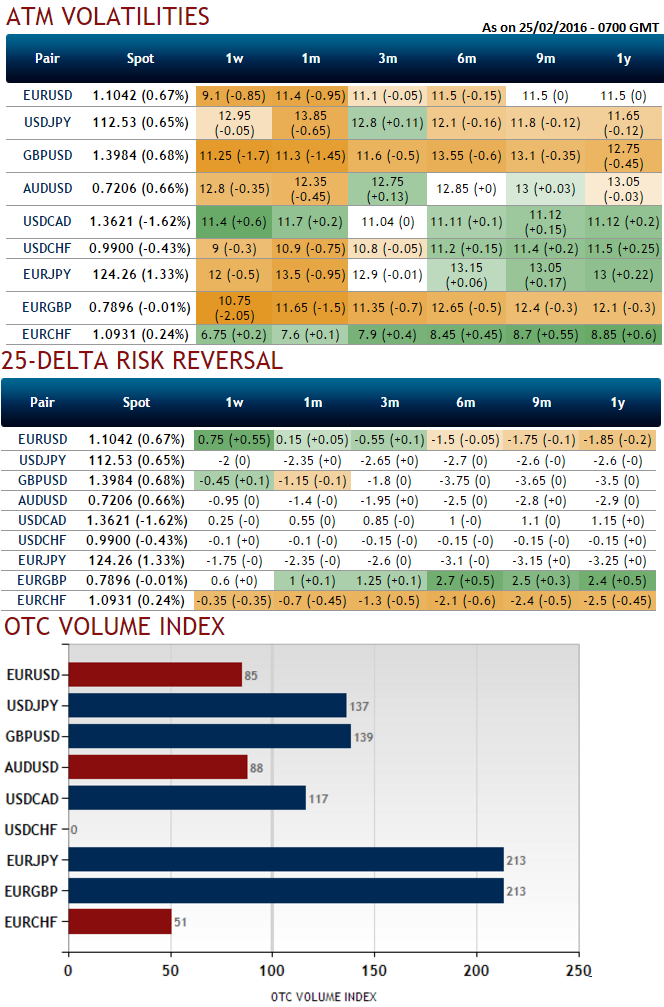

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for EURCHF was turning into negative over the period of time.

From the nutshell, if you see 25-delta risk of reversals of EUR/CHF for 1 week tenors, there is nothing much happening in OTC but in a long run hedging activity favors bears, the most cheapest pair to be hedged for downside risks after AUDUSD as it indicates puts have been over priced.

While ATM vols have been lackluster for contracts of all time frames which means the underlying spot FX market for this pair is anticipated to have no dramatic movements in the futures.

Put Butterfly Construction:

Spread ratio: (Long 1: Short 2: Long 1)

Go long in 1M (1%) out of the money delta put

Short 2 lots of 2W at the money put

Go long in 1M (1%) in the money delta put.

Maximum loss for the long put butterfly is limited to the initial debit taken to enter the trade plus commissions.

FxWirePro: Use EUR/CHF butterfly spreads on tepid OTC market set up, IVs tepid and neutral risk reversals but bearish bias in long run

Thursday, February 25, 2016 2:20 PM UTC

Editor's Picks

- Market Data

Most Popular