US crude and product demand at seasonal highs now. Crude supply flattening out.

The oil markets will be focused on several key supply questions in the coming weeks and months. How much production will OPEC and Russia actually cut? How quickly will US crude supply return to growth in a $50-60 world? How much of a recovery in output will we see out of Libya and Nigeria? Of course, we have our views, as discussed in recent publications. But until we start to get answers, the debates will continue. In the meantime, the markets have priced in significant OPEC cuts.

While tanker tracking data should give some indications on OPEC as January unfolds, it will be mid-February before there are decent IEA and OPEC figures for January. Until then, we believe that markets will enter a “wait and see” mode; crude prices are likely to start trading within a relatively wide range. We wouldn’t be surprised to see Brent test $50 during this “data vacuum” period.

Option-trade recommendation: Strangle Shorting

As we foresee narrow range trend is puzzling this pair on both intraday and weekly charts,

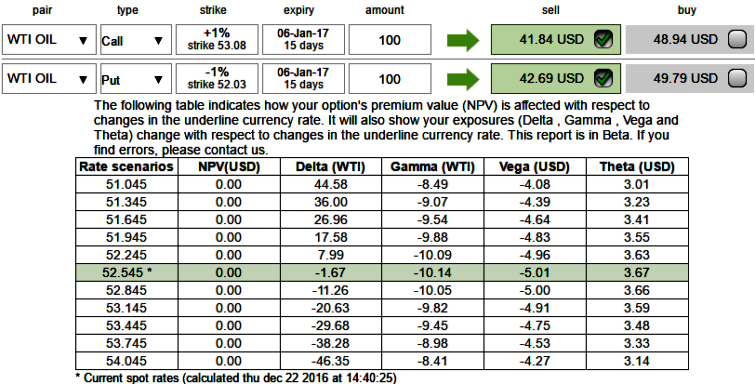

At current spot at 52.50 with range bounded trend keeping in consideration, we would like to remain in the safe zone by achieving certain returns though shorting a strangle.

Naked Strangle Shorting

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 14 days

Volatility: lower volatility expected

The execution: As shown in the diagram, short 2W OTM put (1% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Maximum returns for this strategy is achieved when the WTI spot price on expiry is trading between these OTM strikes as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

Remember, this strategy exclusively for the speculative purpose. Maximum loss for this strategy is to the extent of when the underlying spot FX on expiration date is trading beyond the strike prices of the options written.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis