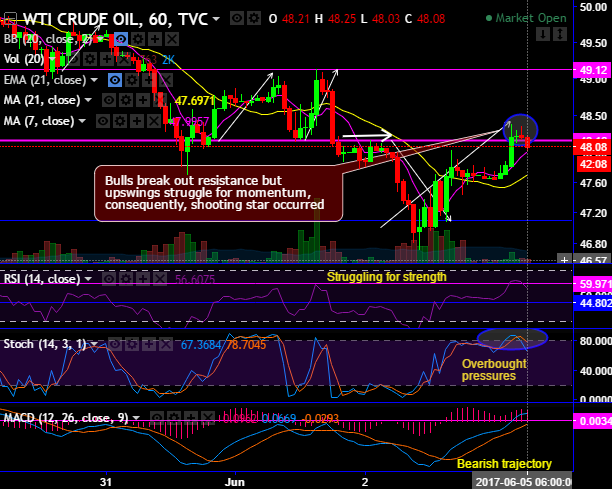

On hourly charts of this energy commodity prices, although the bulls break out the strong resistance at 48.16 levels, we don’t encourage longs despite today’s upswings. Instead, we are slightly skeptic about bullish swing continuation for delivery positional trades due to following technical indications.

The bull candle with the large real body is traced out at 48.22 levels and as a result, bulls have managed to break out resistance but upswings struggle for momentum, consequently, shooting star has occurred at 48.21 levels.

The Saudi Arabia, Bahrain, and UAE cut diplomatic ties with Qatar as Gulf rift deepens, this topic continues to be the hot topic for the day. While US inflation fell to -0.2% MoM. While crude inventories have declined to -6.4 million barrels as on last US crude oil inventory check.

Both leading indicators are indicative of overbought pressures, stochastic curves have reached above 80 levels, and there has been %D crossover which is a sell indication. Subsequently, RSI evidences the shrink in strength in previous upswings.

The current prices seem to be attempting to slide below SMAs but cushioned at 7SMAs.

But on a broader perspective, the major trend still goes in non-directional, the consolidation phase in the major downtrend seems to be continued and stuck in range (see the rectangular area on monthly charts).

But breaks below baseline of ascending triangle likely to cause more weakness in upcoming months, both leading & lagging oscillators indicates price slumps

RSI on this timeframe indicates indecisiveness but slightly bearish biased, while same has been the case on stochastic curves, this leading oscillator has also been bearish bias.

While MACD indicates the slumps in the prices on monthly terms remaining bullish trajectory. Overall, you see no traces of indications of robust uptrend at this juncture.

Trade tips:

On intraday terms, as there is a mixed bag of technical indications, we advocate buying boundary binary options for speculation. Well, on trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 48.39 and lower strikes at 48 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.