Although the WTI crude prices have bounced back again from the lows of $39.24, the fundamentals of this energy commodity have still been fragile.

The improvement in these fundamentals remains fragile and continues to feature large offsetting forces: The wildfires as an added edge have assisted to offset surprisingly strong Iran production, whereas the slowing demand growth in India and China in H2 of 16 would assist to offset the production issues in Nigeria and Venezuala and finally product builds have offset crude draws. Post-Brexit anomalies in conjunction with global slowdown have hampered the demand and business prospects from EM space.

According to Longson, a “sizeable” amount of Sept. WTI put positions at $40, $45 recently came into or near the money, leading to spike in hedging by traders to cover their exposure. However, the good news for oil bears is that the effect of this action would shrink away once option expires Aug 17th.

Well, the recent price gains are deemed as a mere manipulation of the artificial supply control by the OPEC nations. Hence, going forwards, the crude prices would remain in the $45-$50-a-barrel range till mid-2017, with little to change the global supply and demand situation. Saudi Arabia and Iran account for 50% and 20% of that 2.1 mb/d, respectively.

Back in April, Saudi Arabia refused to sign up to any production freeze without Iranian participation. Fresh after the removal of export sanctions, Iran was unwilling to comply as it sought to ramp up its own production. Since then Iran has boosted oil production to 3.7 mb/d from 2.8 mb/d.

Hedging Strategy:

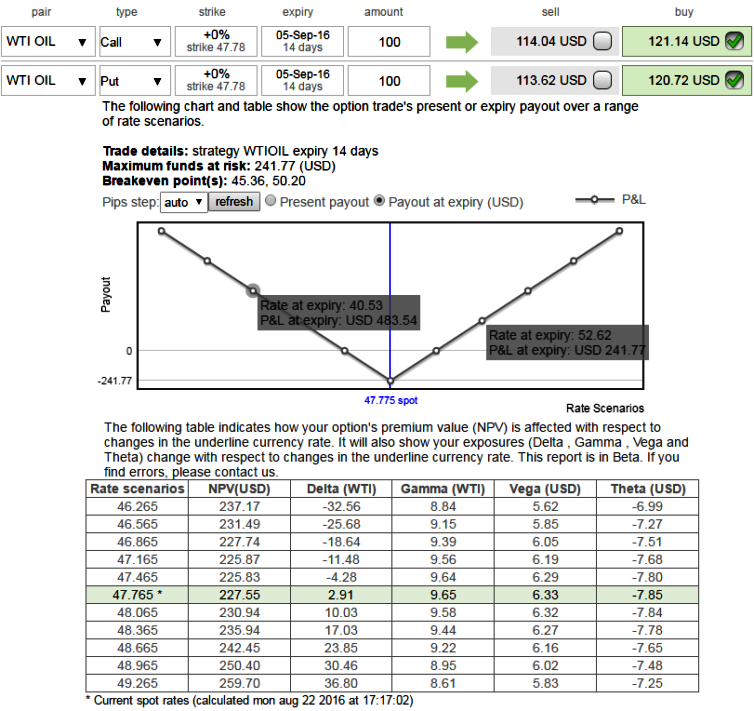

Deploy straddles using At-The-Money calls and puts in this dubious situation.

We are still dubious about WTI crude’s long-term uptrend but because of bullish sensation backed by the speculation from oil minors in supply glut, we also foresee trend seems to be non-directional which is evident in this pair on weekly charts.

Since it should not damage the crude traders we like to remain in safe zone and hence, the recommendation would be buying an ATM straddle as shown in the diagram using at the money +0.51 delta calls and simultaneously at the money -0.49 delta puts of 2w expiries, thereby, one can benefit from certain returns or arrest uncertainties in the price risks even if the pair breaks out on either side in this span of 2 weeks.

As shown in the diagram, the highest returns can be achieved when the underlying crude price is greater than the strike price of long ATM call plus net initial debit or when the underlying crude price is less than the strike price of long ATM put minus net initial debit.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025