The disappointment continues from OPEC member states to reach any consensus initially.

The fact that members were unable to set any production limit means that a continued high level of production is likely, which will leave the market oversupplied.

The US EIA's short-term energy outlook confirmed that oil production seems robust at the current edge, (growing production in the Gulf of Mexico factors in), and therefore raised its production estimate for the current year again slightly.

Brent costed less than $40 per barrel again yesterday for the first time since February 2009 but recovered up to 40.46, WTI has been lingering with bearish favorite figure at 37.5 ahead of inventory data.

Hedging Frameworks:

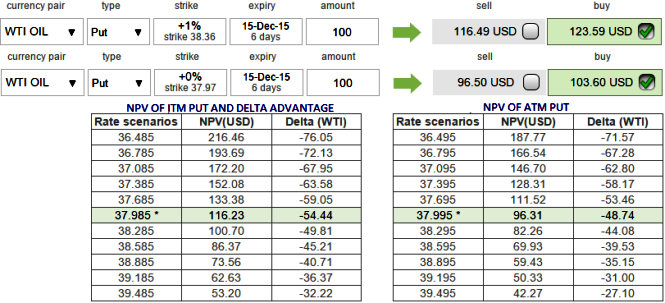

On hedging grounds, aggressive bulls can initiate long positions in naked puts but avoiding at the money puts would derive smarter approach.

But use of in the money -0.51 delta puts are advisable expecting deeper tunnel around 35 levels.

Rare opportunity:

The premiums of ATM contracts are priced in more than 7.56% of NPV while delta is just -0.48.

The premiums of (1%) ITM contracts are priced in more than 6.34% of NPV while delta is -0.54.

Thus, we reckon ITM options are in the competitive advantage of pricing as well as underlying effects on options.

This difference in delta is conducive to monitor downward directional risk which is intensifying amid crude supply glut, so you may know how much your option's value will increase or diminish as the underlying movement in crude oil market.

FxWirePro: WTI crude may head towards deep tunnel - Aggressive bears can stay hedged with ITM delta puts

Wednesday, December 9, 2015 2:59 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: USD/CAD steadies around 1.3680,retains bid tone

FxWirePro: USD/CAD steadies around 1.3680,retains bid tone  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186

EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186  FxWirePro: GBP/USD slips ahead of Manchester local election

FxWirePro: GBP/USD slips ahead of Manchester local election  FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary