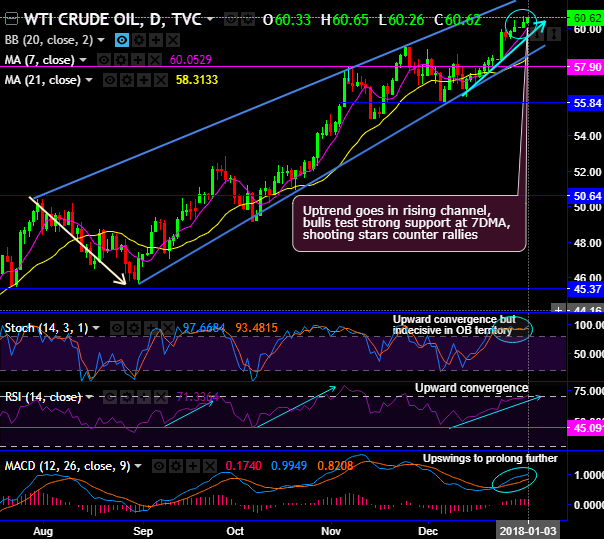

Chart pattern formed - Rising wedge, shooting stars on daily terms and Symmetric triangle resistance break-out and extension of consolidation phase by retracing upto 38.2% Fibonacci retracements on monthly terms.

The bull run of WTI crude prices has been spiking through rising wedge pattern, shooting stars have occurred at $60.09 and $60.33 levels to counter these rallies. But bulls have shrugged off these bearish patterns today despite both leading oscillators approached overbought territory.

Please observe price oscillation as and when the price touches wedge resistance and support.

For today, the prices are almost unchanged from the highs of yesterday (i.e. $60.71), despite ongoing buying sentiments.

On a broader perspective, bulls in the consolidation phase have managed to break symmetric triangle resistance decisively and sustain above, consequently, the current prices spike above EMAs & retraced 38.2% Fibonacci retracements.

But on the contrary, let’s have a glance through the major trend that was bearish now has gone into consolidation phase that was jerky way back in mid-2015. From massive slumps from the peaks of $114 levels shouldn’t be disregarded and jumping to conclude this as a robust uptrend would be unwise, it is just 38.2% retracements.

Having mentioned that, we aren’t a pessimist, for now, more rallies on cards upto another major resistance at $62.50 upon bullish EMA crossover.

Major supports are observed at $60.01, $59.31 and $57.18 levels.

While the stiff resistance is seen at $62.54 levels in the major trend. Failure swings are observed at the same juncture in the recent past.

Aggressive bulls are now lingering on these pivot levels of $60.10-$60.71.

While both leading oscillators have been converging upwards but indecisive currently.

The sustenance above DMAs with bullish MACD crossover will more likely to break out these levels and head for next resistance.

Trade tips:

It is wise to use dips to deploy long hedges using forward contracts, we advocate adding longs in near-month futures with a view to arresting upside risks.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?