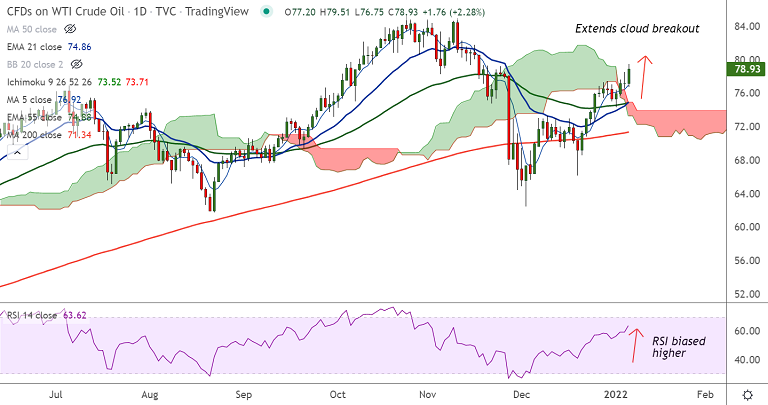

Chart - Courtesy Trading View

West Texas Intermediate (WTI) oil prices spiked over 2.5% on the day after a brief pause in the previous session.

Oil prices ignored Doji formation in the previous session and surged higher despite negative headlines.

Oil markets extended gains even after OPEC+ producers stuck to an agreed output target rise for February.

Surge in the U.S. fuel inventories due to sliding demand as COVID-19 cases spiked had little impact on the oil prices.

Technical indicators are bullish, volatility is high, scope for further upside. Little resistance seen till 85.39 (Oct 21 high).

5-DMA is immediate support at 76.93. Bullish invalidation only below 200-DMA.