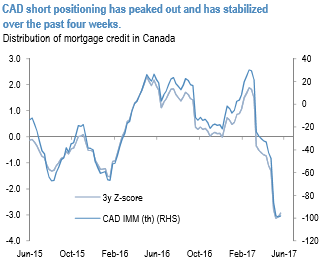

In May, CAD appreciated over 2%, retracing more than half of late April sharp sell-off. In part, this triggered by the broad USD sell-off that unfolded following weak data and the emergence of US presidential scandal risk. But it also came as concerns over housing market risks (which played a major role triggering the earlier selloff) faded while CAD short positioning peaked out (refer above figure).

In these pages last month we flagged that although housing market risks was an ongoing medium-term vulnerability, they were not yet acute and the idiosyncratic issues behind one mortgage loan company were unlikely to cause a broader fallout.

Post-retracement, CAD is looking more fairly valued, if not slightly expensive. Where the earlier selloff had looked to have overshot on the weak-side by as much as 1.6%, post-retracement, CAD is now screening 1.2% expensive on short-term fair value models. This is largely because it was insensitive to the 12% decline in crude oil prices, which all things equal should have been worth 1% weaker in CAD.

However, also helping offset a weakening impulse from oil prices was the fact that BoC is finally starting to rotate away from its dovish stance it had held for the better part of the last year, first the May monetary policy statement, and in yesterday’s Financial Stability Review press conference.

Use options spreads and combinations to tackle this pair as shown below:

Long 2m USDCAD 1.3280-1.3680 call spread; sell 1m 1.29 put.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary