The decline of FX vol levels after the late July spike has continued steadily over the past few weeks, under the powerful influence of dovish major Central Banks quenching global recession fears, and as the market has started to price in an imminent US/China trade deal.

In this context, FX short-Gamma strategies have delivered solid performances, with the benchmark portfolio we monitor of 1M 25-delta strangle strategies up 9.7% so far in 2019.

Our tactical filtering model, which has helped cutting the August drawdown at the expense of a slightly lower yearly performance (+8.0%), remains heavily biased towards short-Gamma, with the latest average signal at 89% of the max short-Gamma trade allowed.

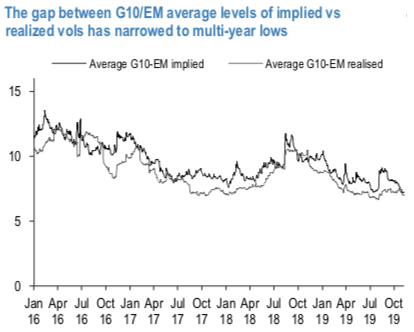

A natural benchmark for judging on the valuation of implied vol levels regards the level of realized volatilities; when averaging over liquid G10/EM USD pairs (refer 1st chart), the gap between the two, or vol premium, has narrowed to multi-year lows. Also, while the August spike of implied vols proved to be short-lived, realized vols exhibited some resilience over the period, leaving less room for dropping lower, unless new market micro-structure forces were to come into play. From this perspective, room for further declines of vol levels, and consequently for further short- dated gains of short-Gamma strategies, appears to be limited at the moment.

We have recently introduced a macro model linking FX vol levels to the underlying rates vols/correlation dynamics. The model (refer 2nd chart) has done a pretty decent job in terms of tracking the evolution of vol levels over time. The average vol level is undervalued by 3 standard deviations based on the model, but in vol terms (7.3 vs 8.2), this amounts to less than 1 vol point. So, from this standpoint, while we see room for a marginal repricing higher of vol levels, potential is fairly limited.

The two analyses above point to a relative balance between opposite forces driving FX vols: absent major surprises on the trade front, one could expect some near-term stability as far as FX vol levels are concerned. In the following, we’ll investigate how the current interplay of pricing parameters in a low vol market can guide in the search of directional option plays. Courtesy: JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data