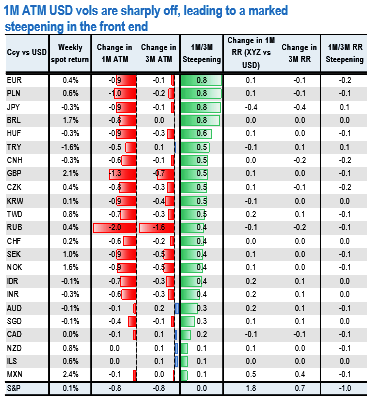

The FX vol market is showing signs of capitulation and front-end vols are softer over the week, leading to vol steepening across the board.

Softer vols in U.S. could provide a momentary soft patch as the Dow Jones broke the symbolic threshold of 20000 on last Wednesday, tripling in nominal value since the lows of 2009, markets seem wrapped up in a spell of euphoria that can only signal radiant optimism on US cyclical upturn and immense credit granted to Trump's emphatic "America First" agenda of protectionism: fiscal easing, infrastructure spending and deregulation. In equity markets, a decent start to the Q4 earnings season is further helping vols flirt with all-time lows.

At 8.5, 1M S&P vol is just a few decimal points above the abnormally low trough of Jun-Jul 2014. While the price action in FX vols doesn’t suggest the same level of complacency, this softness in front end vols is spilling over to 1M USD vols and sending them sharply lower across the board (refer above nutshell).

As March FOMC and the first round of a particularly disputed French presidential elections keep 3M vols firm, this is leading to a marked vol steepening. Such moves are a hallmark of either capitulation or opportunistic profit taking from investors who started the year with a long vol bias -many of them reluctantly as the position suffered from the frailty of garnering a broad consensus.

Long USD IMM positioning at 1yr highs have certainly played a catalyst role in this capitulation, and the upcoming Chinese New Year period of Asian market closures is likely adding to the mood. The market exasperation with front end USD vols is hardly justified by actual gamma performance.

At least if one looks at vol swap returns YTD, and one would be more justified in judging EUR cross vols as expensive to hold. It is not the case that USD gamma is painfully underperforming as of yet, especially when a pair like GBPUSD is able to deliver its largest short squeeze rally since the Brexit vote.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis