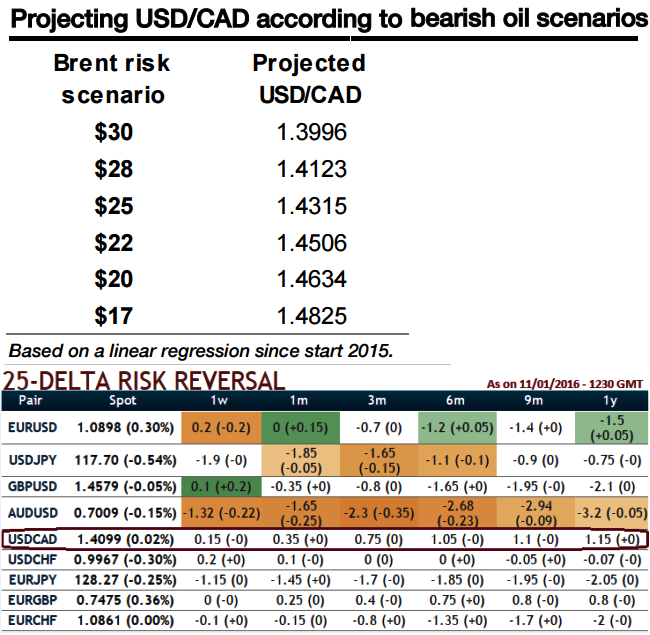

Had you expected Brent prices to travel southwards upto $20 in discounting a new oil paradigm in a worst-case risk scenario cannot be totally ruled out, then USD/CAD effortlessly broke its psychological resistance at 1.40 and technicals signal that the down move below $31.50 could extend possibly towards next meaningful supports at $25 and $20.

The apprehension in the Middle East, the threats of a nuclear test by North Korea, weak China slowdown signified by their PMI and the PBoC speeds up the currency depreciation are all undermining market risk appetite. At the same time, oil sensitive currencies are naturally feeling the pain.

According to the USD/CAD options, the probability that the spot will trade above 1.51 in three months is 8.3%. The actual probability of such an event is likely to be even lower. It would involve a break of the FX/oil relationship, and require a 10-figure move over a quarter from 1.41, coming from 1.28 bottom in October.

Risks USD/CAD acceleration beyond 1.51 The structure is a call spread with a knock-out barrier only on the long call, set above the strike of the short call. As long as the barrier is not hit, the profit is capped by the difference between the two strikes.

The CAD robustly keeps the highest oil correlation in FX space and would feel more pain in this case (see scenario table).

The structure is a call spread with a knock-out barrier only on the long call, set above the strike of the short call. As long as the barrier is not hit, the profit is capped by the difference between the two strikes. However, hitting 1.51 at any time would cancel the long call, suddenly exposing investors to unlimited losses while the USD/CAD trades above the 1.47 strike.

Buy ATM USD/CAD 3M call strike 1.4212 Reverse-Knock-Oout 1.51, Sell call strike 1.51 with relatively shorter expiries, spot ref: 1.4212 A buy-and-hold hedge.

Our structure is primarily a buy-and-hold strategy, since it gradually accumulates time value until expiry. The maximum profit is reached in the range 1.47-1.51 and the hedge starts to be effective at 1.42. If the spot appreciates early, investors will have to wait to be refunded by the positive theta.

FxWirePro: What if oil goes to $20? The spillover effects on CAD to prop up 1.51 in Q1 2016

Tuesday, January 12, 2016 11:58 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed