In Turkey, the CBRT disappointed consensus and market expectations of 100bp of hikes to the late liquidity window (to 13.25%) by hiking only 50bp to 12.75%. The 50bps rate hike is not sufficed to stabilize the currency, as per our stance.

The Central Bank of Turkey held its benchmark one-week repo rate at 8 pct and raised its late liquidity window rate by a less-than-expected 50bps to 12.75 pct on December 14th, in an attempt to curb rising inflation amid strong economic growth. Annual inflation rate hit a 14-year peak of 12.98 pct last month, way above the central bank's target of 5 pct, and core inflation hit a near record high of 12.08 pct.

Following consecutive inflation misses, inflation inertia is high with 24-month ahead inflation expectations rising further to 8.6 pct in December from 8.3 pct in November. The current account deficit is running at 6.8 pct of GDP in 3-month momentum measures, with financing likely to be more difficult going forward.

Over the past 12 months, $21bn of the $42bn current account deficit was financed by portfolio flows. Such strong portfolio inflows will be very hard to repeat without a more credible monetary policy backdrop.

Additionally, support from local FX selling has now also waned. After selling $10bn of FX between the end of September and end of October, locals have now switched to FX buying adding $5.5bn to holdings since early November.

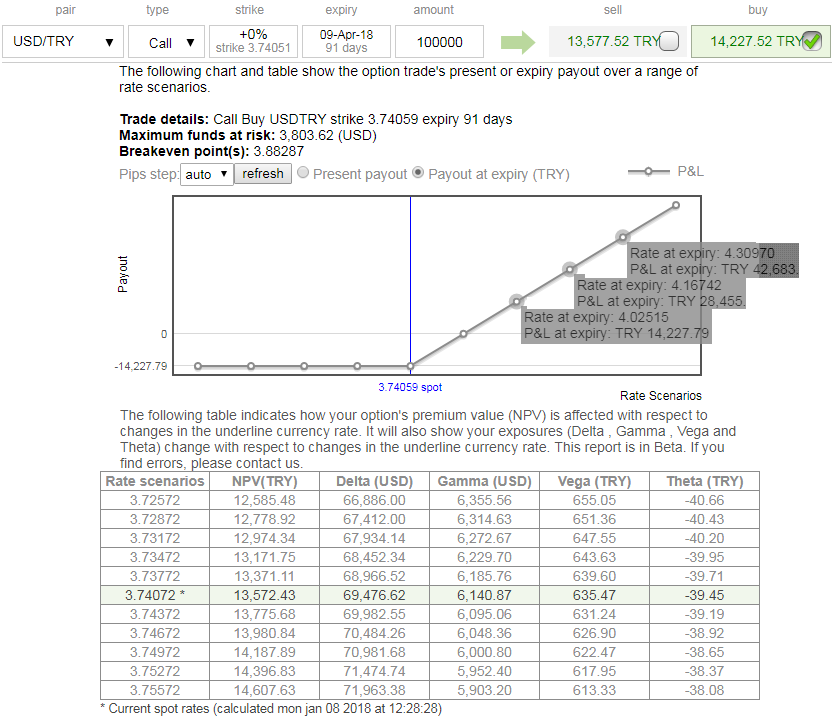

As such the 50bps hike, which still keeps real policy rate negative vs. headline inflation at 13% yoy, is clearly insufficient. It is projected that the further sharp FX weakness to force the central bank into a more credible tightening. While we remain UW FX and hold an outright USDTRY ATM +0.51 delta call (spot reference: 3.7402) of 3m tenors. You hold this derivative contract on both hedging as well as trading grounds, please observe payoff structure that flies exponentially as the underlying spot FX keeps spiking northwards.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics