The BoJ maintains status quo in its monetary policy, it seems that the central bank is focused soothing 10Y Treasury bond yield, the benchmark for long-term borrowing costs, at around zero pct and keep the overnight interest rate around -0.1%. and asset purchases program at ¥80 trillion.

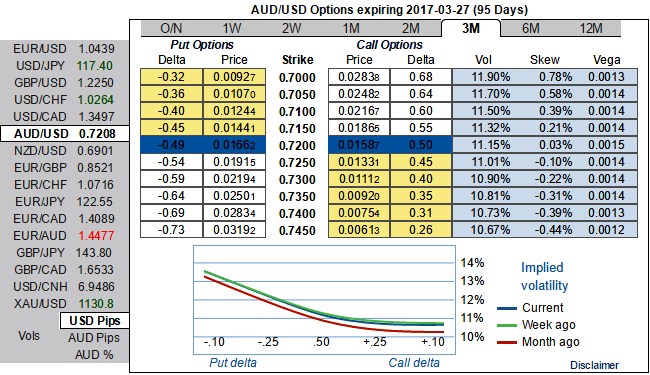

Although you could spot out positive changes in 1m risk reversals and ongoing spikes in the underlying spot, the positively skewed 1m IVs would still keep us alerted on downside risks and same has been the case with 6m skews.

As a result of the short-term bullish swings and major bearish pressures caused firstly by the European central bank with its soft taper as well Bank of Japan’s status quo, we devise below option strategy in order to monitor both puzzling swings.

The diagonal bear put spread strategy is recommended that involves buying long-term puts and simultaneously writing an equal number of near-month puts of a lower strike.

The strategy is constructed at net debit but with a reduced cost by writing (1%) 1m OTM put option, simultaneously, buying (1%) 6m ITM +0.67 delta put options. The Delta represents the option’s equivalent position in the underlying market. A higher (absolute) Delta value is desirable for an option buyer as the holder of an option looks for their option to be more valuable.

We’ve chosen ITM longs because an option moves further in-the-money in 3-months' span, the Delta’s absolute value rises and it becomes more valuable on every corresponding pips (or points) movement in the underlying spot FX.

This strategy is typically employed when the options trader is bearish on EURJPY spot FX over the longer term but is neutral to mildly bullish in the near term that is stated above.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand