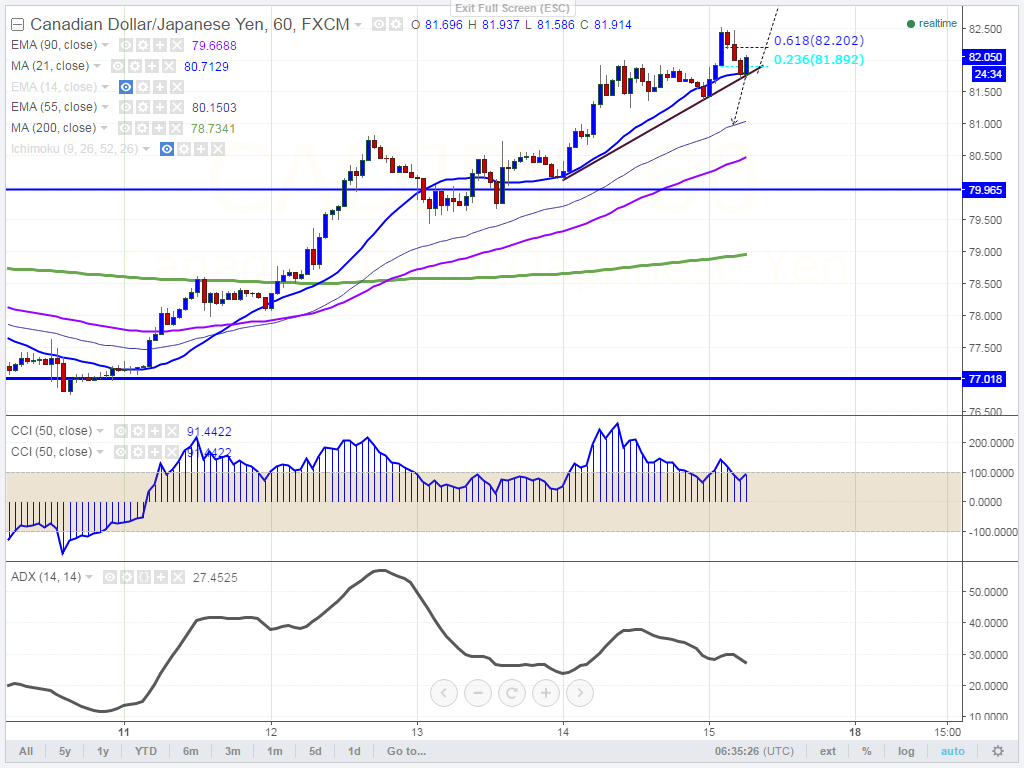

- Major support – 81.69 (trend line joining 80.12 and 81.37)

- The pair declined till 81.70 at the time of writing after making a high of 82.518. It is currently trading around 82.03.

- In the hourly chart the pair trades slightly above Tenkan-Sen (81.94) and Kijun-Sen (81.59). So a short term weakness only below 81.69.

- Any violation below 81.69 will drag the pair down till 81 (55 H EMA)/80.43 (90 H EMA).

- On the higher side, resistance is at 82.20 (61.8% retracement of 82.51 and 81.70) and any indicative break above targets 82.51/83.01.

It is good to buy at dips around 81.95-82 with SL around 107.40 for the TP of 108.45/109.10