Technical Inference:

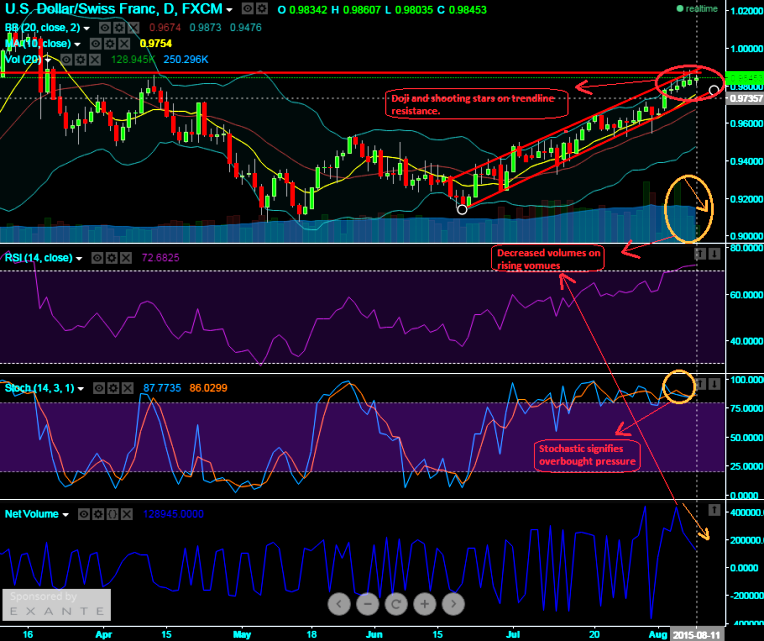

The bearish candles such as shooting star and doji pattern are piling up on USDCHF pair. All these 3 bearish candles occurred on uptrend rallies at peaks.

The highs of these bearish candles were not ready to sustain as they were testing trendline resistance at 0.9820 (Doji), 0.9882 (Shooting star) and again at 0.9890 (shooting star). More importantly as you can see the pair is moving in channel, any attempt of approaching either upper or lower channel was suppressed and moved in opposite direction.

The bearish senses are built as the volumes are considerably sipping with rising prices. While %D line crossover above 80 levels pilling up the overbought pressure.

Above technical reasoning is applicable only for short term correction which are on the cards but certainly not for the long term investors. So one can utilize this as speculating chances by attempting to capture the right swings.

Hedging Perspectives:

USDCHF is the one among the major currency pool to perceive higher volatility of ATM contracts, ATM contracts currently trending close to 10% vols. While doing so it seems like the OTC option of this pairs have tons of Gamma. This is arrested by devoting little time on ascertaining an accurate gamma. We've constructed call spread by considering gamma closer to zero would neutralize the implied volatility impact on option price and this position remains quite firm to achieve our hedging objectives, because we know gamma represents the change in delta, we have healthier delta at 0.48 at combined position. This results in desired hedging objective irrespective implied volatility disruptions as we've OTM shorts on side and prevailing bull run will be taken by In-The-Money calls.

FxWirepPro: Highs of USD/CHF Shooting Star and Doji fail to break trendline resistance at 0.9845, gamma spreads on HY vols

Tuesday, August 11, 2015 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?