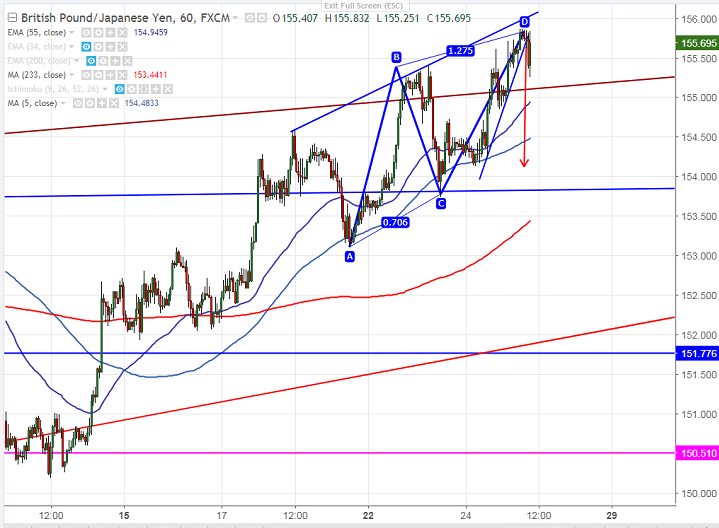

- Harmonic pattern – Bearish AB=CD pattern

- Trend line support- 155.50.

- GBP/JPY has been declining after forming a top around 155.85. The pair formed Bearish AB=CD pattern and any further bullishness only above 155.85. It is currently trading around 155.41.

- On the lower side, major intraday support is around 155 (hourly Kijun- Sen) and any break below will drag the pair to next level till 154.45/154. Major weakness can be seen below 153. Level.

- The near term resistance is around 156 and any break above will take the pair to next level till 157/158.

It is good to sell on rallies around 155.65-70 with SL around 156.25 for the TP of 154/153.