The GBP/JPY pared some of its gains after dismal UK retail sales. It hit an intraday low of 195.69 and is currently trading around 195.90. Intraday trend is bullish as long as support 193.70 holds.

In May 2025, UK retail sales underwent a marked and unexpected decline, dropping by 2.7% compared to the previous month—a notably steeper fall than the anticipated 0.5% decrease. This downturn contrasts sharply with April’s 1.3% increase, which had been supported by favorable weather conditions. On an annual basis, retail sales volumes fell 1.3% below levels seen a year earlier, a significant reversal from the 5.0% growth recorded in April. The contraction spanned multiple sectors, with food store sales experiencing the most pronounced decrease at 5.0%, alongside declines in non-food and department store categories. These trends suggest a renewed caution among UK consumers, highlighting concerns over the fragility of the nation’s economic recovery and posing potential implications for upcoming Bank of England policy decisions.

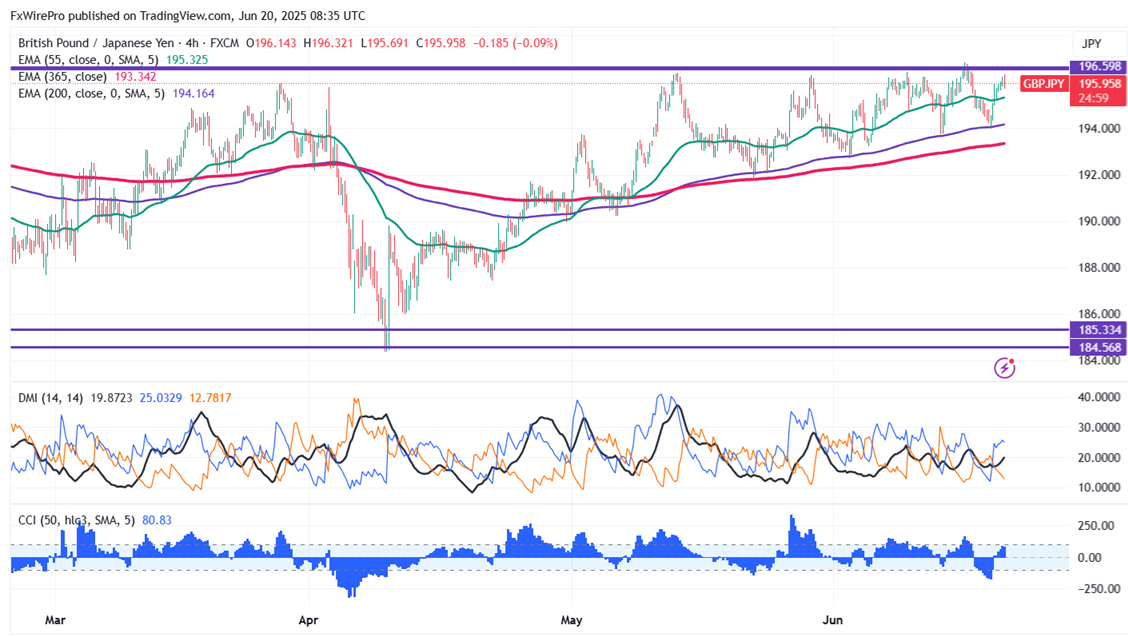

‘The GBP/JPY pair is trading above 34 and 55 and 200 EMA (Short-term) and 365 EMA (long-term) on the 1-hour chart, confirming a bullish trend. Any violation below 195.35 indicates the intraday trend is weak. A dip to 195/194/193.70 is possible. Immediate resistance is at 196.35 a breach above this level targets of 196.85/198/200. Any major uptrend is possible only above 196.85.

Market Indicators (1- hour)

CCI (50)- Bullish

Directional movement index - Bullish

Trading Strategy: buy on dips

It Is good to buy on dips around 195.50 with SL around 194.70 for a TP of 198/200.