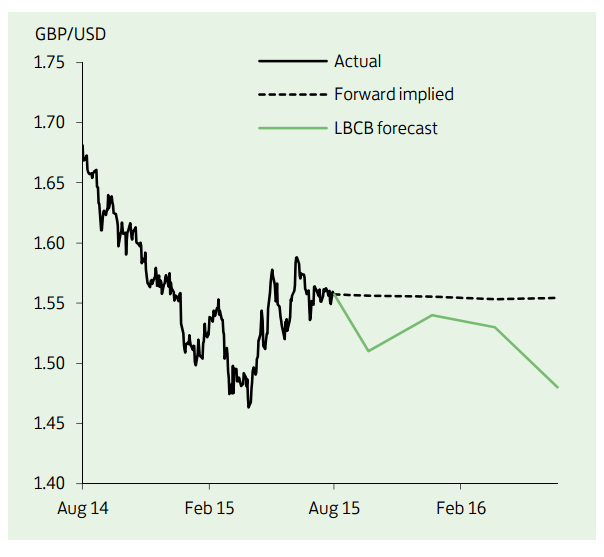

Having spent the past month in a fairly narrow range, GBP/USD ended much where it began, just above 1.56. This lack of movement was partly attributable to thin summer trading conditions. But more fundamentally, it appears to reflect a general belief that the mid-1.50s for GBP/USD represents fair value. At the margin, shifting expectations about the prospect of near-term interest rate increases in the US and UK have impacted on currency sentiment.

In the US, the latest FOMC statement and relatively robust July employment report has left open the possibility of a US rate rise as early as next month. In contrast, the dovish tone of the BoE's latest policy minutes and Inflation Report suggest a UK rate rise this year is now unlikely. The difference in signals between the FOMC and the MPC suggests UK monetary policy is likely to remain relatively looser for longer. This, coupled with the UK's external imbalance and the possibility of heightened Brexit uncertainty, is expected to weigh on GBP/USD over the medium term. A drop below 1.50 is targeted by June 2016.

GBP/USD Outlook

Wednesday, August 12, 2015 9:08 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed