Retails sales MoM is increased 1.2% in April of 2015 over the previous month bouncing back from a 0.7% dip in the previous period and beating market expectations.

CBI industrial orders trend: Factory orders in the UK decreased 5% in May of 2015 over the previous month against forecast at 3% as reported by the Confederation of British Industry. This industrial trend survey has been quite disappointing for forecasting perspective.

BoE's governor Carney's speech is scheduled tomorrow, Bank of England's Monetary Policy Committee voted to maintain the Bank Rate at 0.5% at its May 11th, 2015 meeting.

Technical mirror:

We anticipate these numbers boosts up the uptrend momentum for GBP in an intermediate trend. The intermediate trend has been uptrend only with certain confirmation from RSI (14) converging view to the price line.

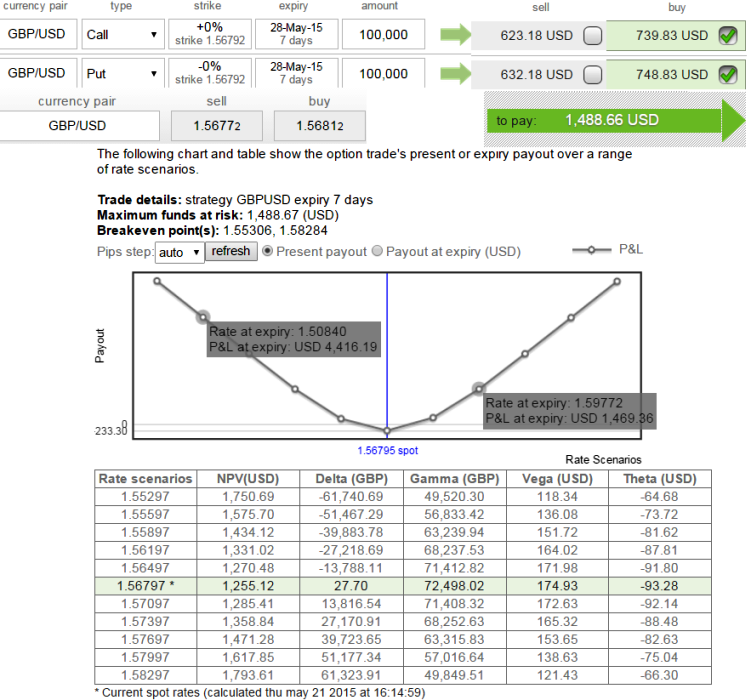

Option Strategy: Combinations (Buy a Straddle GBPUSD)

Overview: Non directional or slightly upwards

With a series of significant economic data this week, the above strategy can help safeguarding the currency portfolios from any abrupt uncertain currency movements.

How to build: Buy both call and put options of same strike prices and same expiry in order to build this strategy. Best suitable on the verge of economic news or earning seasons etc.

This is best suitable when hedger believes that the price of the underlying currency will make a strong move in either direction in the near future.

It can be constructed by buying an equal number of ATM call and put options with the same expiration date.

Portfolio equation:

Maximum Return = Unlimited

Profit Achieved When Price of Underlying > Strike Price of Long Call + Net Premium Paid OR Price of Underlying < Strike Price of Long Put - Net Premium Paid

GBPUSD MT4 options offer floating & fixed spreads on instant execution:

MT4 floating spreads at Min 1.2 & Avrg - 2.1

MT4 fixed spreads at day - 1.8 & night - 2.1

Swap Long: 0.04 pips

Swap Short: -2.61 pips

GBPUSD straddle hedges non directional momentum

Thursday, May 21, 2015 11:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?