According to latest data from Markit, investors are flocking into UK bond market. ETF's saw their biggest weekly inflow of $123.4 million, in at least 12 months, according to Markit.

UK bonds are best performer in last two weeks among developed market peers, which forced the yields to slide sharply.

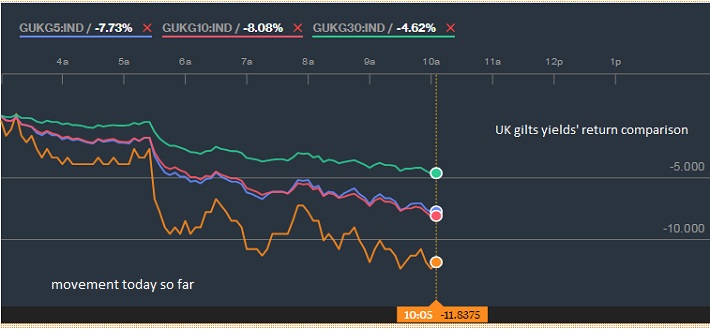

Majority of the slide is occurring at shorter end of the curve.

In last one week, (starting 26th June)

- UK 2 year yield has dropped more than 33% and today alone more than 11%.

- UK 5 year yield has dropped by 20% and today alone more than 7%.

- UK 10 year yield has dropped by 11% and today alone more than 8%.

- UK 30 year yield has dropped by 8% and today alone more than 4%.

What's driving the Gilt?

- A portion of the money is due to safe haven flow from Europe due to concerns over Greece.

- Largely it might be due to shortage of Gilt. UK chancellor George Osborne plans to cut current budget deficit of 5% and move towards a surplus by 2018/19. Which means lower debt issuance by UK government. Since most of the funding is likely to be on the longer end, short end of the curve remains in short supply.

- According to Citi, UK budget deficit could be £ 15 billion lower than originally estimated.

Last week's auction showed heavy demand in issuance market, with bid to cover ratio reached 1.71, highest so far this year.

Pound has fallen victim to lower yields, currently trading at 1.542 against dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary