In response to President Trump announcement that his administration would impose 25 percent tariffs on all Steel imports and 10 percent tariffs on Aluminum imports, the European Union has announced that if the United States moves ahead with such tariffs it would impose counter-tariffs on U.S. goods.

As always, President Trump has remained defiant and asserted that trade wars are good and easy to win since the United States runs a very large trade deficit in goods, to the tune of $800 billion. However, what he forgot to mention is that any war is usually long and can do significant damage to all parties before a victory can be achieved.

Data strongly suggest that while U.S. China trade war is totally different ballgame since the United States exports around $130.4 billion dollar worth of goods while imports $506 billion, a trade war with the EU would significantly damage both before any victory can be achieved.

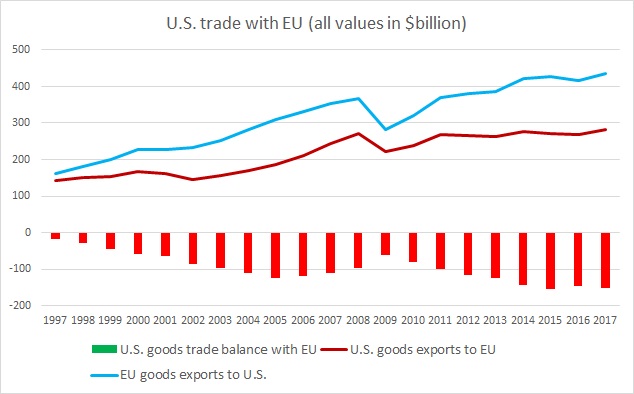

The chart shows, U.S. trade deficit with the EU reached a record high of $151.4 billion in 2017, which suggests that Trump’s trade war might benefit the United States if deficit reduction can be achieved. However, U.S. exports to the EU is not insignificant. While the U.S. imported $434.9 billion dollars’ worth of goods in 2017, it exported $283.5 billion dollars’ worth of goods, which is more than double than what it exported to China.

An all-out trade war with EU would hurt both the economies significantly before the United States can achieve a victory.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed