- Japan - Yesterday Japan reported CPI numbers that showed as expected by BOJ officials CPI has fallen further, with core CPI fallen to 0% excluding the sales tax hike in April 2014.

- UK - UK reported CPI this week that showed price pressure is on the downside. Core CPI grew by 1.2% YoY compared to 1.4% earlier. Monthly CPI is growing just around 0.3% mom.

- US - US reported CPI earlier this week, CPI grew at 0% YoY, however core CPI surprised on the upside growing 1.7% YoY compared to previous 1.6%. This a consecutive second month, when core CPI surprised on the upside. However FED does not target CPI but PCE deflator.

- Euro zone - Eurozone reported February consumer prices last week. The 0.6% increase in the headline rate was the largest since last March. The core rate ticked up to 0.7.

Inflation seems to returning in Euro zone and US, whereas they continue to falter in Japan and UK. However it is still too early to show confidence over its return.

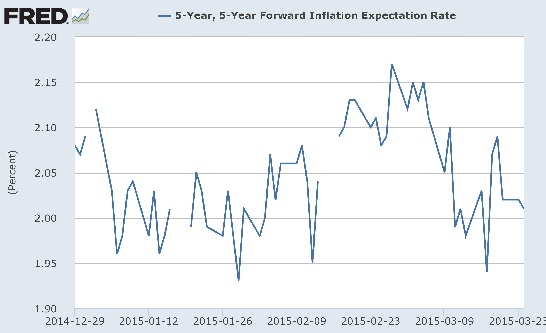

Nevertheless inflation expectations are gathering pace. Inflation expectations, measured by break even rates (difference between conventional yields and yields on inflation protected securities) are rising.

- The 10-year breakeven in the US has risen from about 1.5% in January to 1.6% in mid-march and now hovering above 1.8%. The chart, prepared in FRED dashboard presents another measure of inflation rate 5y5y inflation expectation rate that is firmly hovering above 2% in spite of dovish comments from FED officials.

- German 10-year breakeven has risen from about 0.5% in early January to around 1.25% as of latest. It is consolidating near 1.25% now.

- UK 10-year breakeven is at new highs for the year hovering above 2.6%. In late January, it was near 2.27%.

- Japan's 10-year breakeven is now around 1% from 0.7% in January.

Probably it is a good time to reconsider those ultra-low yields.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate