Gold prices continued their upward trajectory in Asian trading on Wednesday, bolstered by prospects of additional U.S. interest rate cuts. Spot gold rose 0.3% to approximately $1,950 per ounce, while December gold futures approached $1,970 per ounce.

Lower interest rates, which decrease the opportunity cost of holding non-yielding assets like gold, have been a key factor in supporting its recent rally.

hamiltonleen from Pixabay

The Federal Reserve’s recent rate cut and the prospect of further reductions sent the dollar to a multi-month low, providing broader support for metal prices, as can also be seen here in an article from Fox Business. Analysts predict more rate cuts in the coming months, with some expecting the Fed to lower rates by a total of 50 basis points in the near term.

NikolayFrolochkin from Pixabay

Traders are closely monitoring this week's Federal Reserve speeches, including an address by Chair Jerome Powell, for hints on the direction of U.S. monetary policy. Additionally, the Personal Consumption Expenditures (PCE) Price Index, due for release on Friday, will be pivotal in assessing inflation and its impact on future rate decisions.

Precious Metals Mixed Amid Geopolitical Tensions

The weaker dollar has made precious metals more attractive to investors, with gold also seeing safe-haven demand due to rising geopolitical tensions in the Middle East. Supported by an article from T & K Futures and Options Inc., platinum futures remained relatively flat, dipping 0.1% to around $900 per ounce, while silver futures fell 0.5% to approximately $23 per ounce.

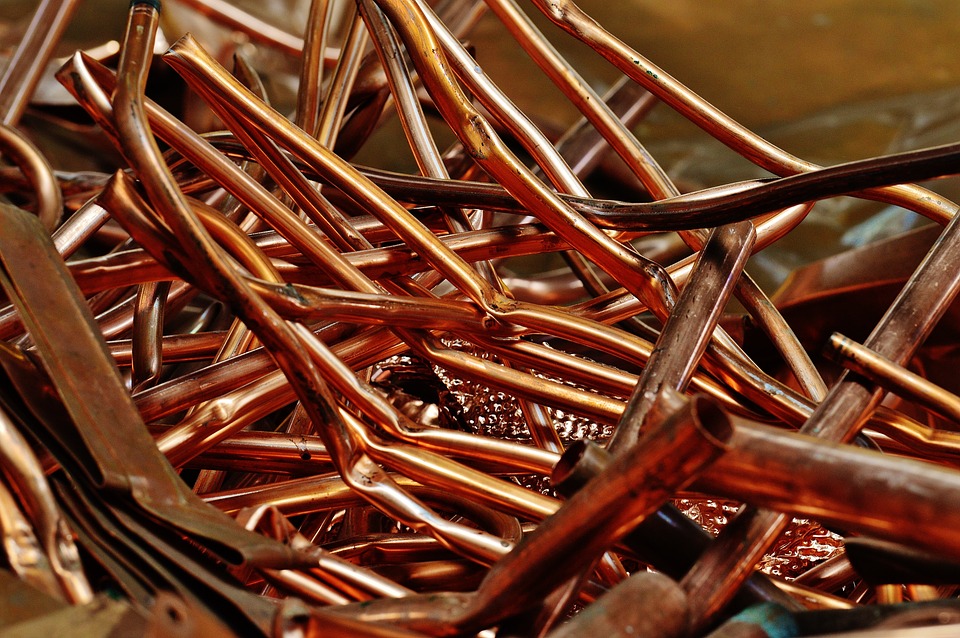

Copper Fluctuates After China Stimulus Boost

Copper prices saw mixed movements, LME Copper reported that benchmark copper futures on the London Metal Exchange increased by 0.3% to around $8,500 per ton, while one-month futures slipped 0.2% to $3.80 per pound.

Copper initially rallied earlier this week after China announced new monetary stimulus measures aimed at bolstering economic growth. However, analysts suggest that additional fiscal measures may be necessary to support a sustained recovery in the world's largest copper consumer.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record