Gold prices are currently trading above $2,650 due to rising geopolitical tensions and declining U.S. Treasury yields, having reached a high of $2,671 and now sitting around $2,669.74. This increase follows Ukraine's use of U.S.-made ATACMS missiles against Russia for the first time, escalating international tensions, particularly after Russian President Vladimir Putin reduced the nuclear threat level. Ukraine also fired British-made Storm Shadow missiles into Russia, indicating a significant shift in their military capabilities and strategy.

Increased Investor Interest in Gold

The SPDR Gold Trust (GLD) has reported a 0.36% increase in its gold holdings, now totaling 875.39 metric tons, reflecting increased investor interest in gold as a safe haven amid economic uncertainty. A notable 38% of surveyed U.S. investors currently hold gold in their portfolios, a significant rise from 20% last year, showcasing the belief in gold as a hedge against inflation and market volatility.

Market Outlook and Key Indicators

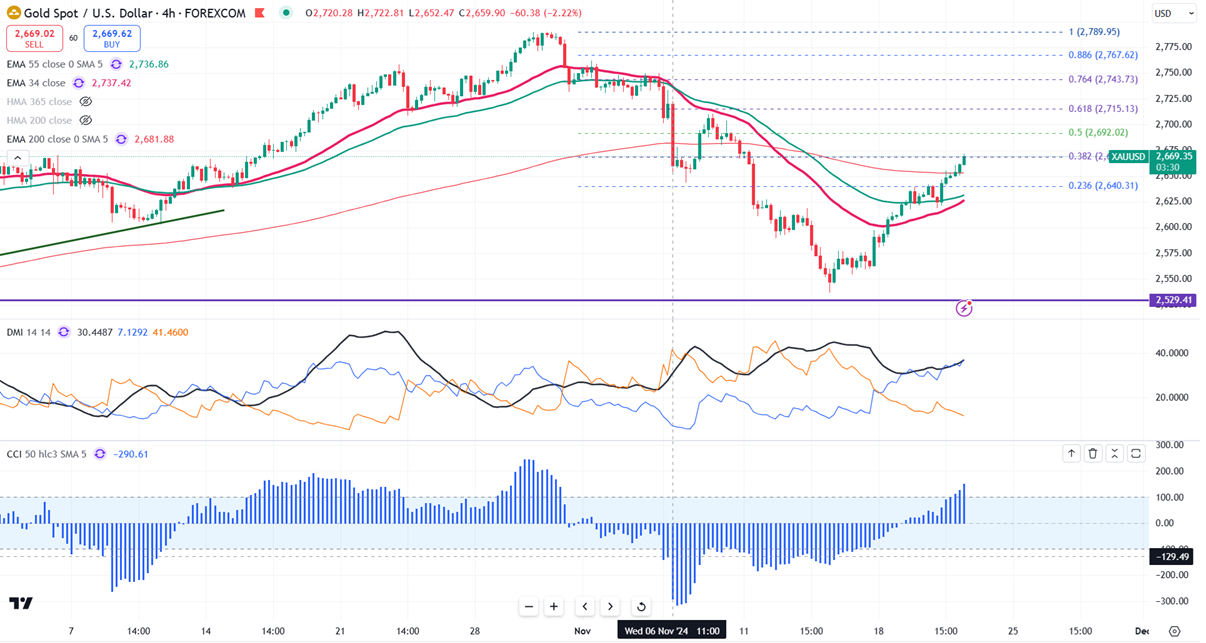

As markets await U.S. jobless claims and existing home sales data for further direction, the technical outlook for gold prices shows them above short-term and long-term moving averages, indicating a bearish trend. Immediate support is at $2,600, with potential declines targeting $2,580, $2,560, and lower. Resistance sits at $2,670; breaking this level could push prices towards $2,700 or $2,725. A strategy of buying on dips around $2,628-30 is advised, with a stop-loss at $2,600 and a target price at $2,700.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings