Gold prices gained sharply on easing US yields and escalation of tension between Russia and Ukraine. It hit a high of $2710 and is currently trading around $2690.

For the week ending November 16, initial jobless claims rose slightly to 213,000, which is still lower than expected and shows the stable job market. Continuing claims also increased to 1.908 million, the highest since November 2021. In October, existing home sales rose to 3.96 million units, beating expectations and showing strength in the housing market despite economic challenges.

Strong jobless claims and existing home sales have reduced the chances of the Federal Reserve making steep interest rate cuts. While the job market appears stable, worries about the housing sector may lead policymakers to be more careful as they consider economic data before their next meeting.

Market Outlook and Key Indicators

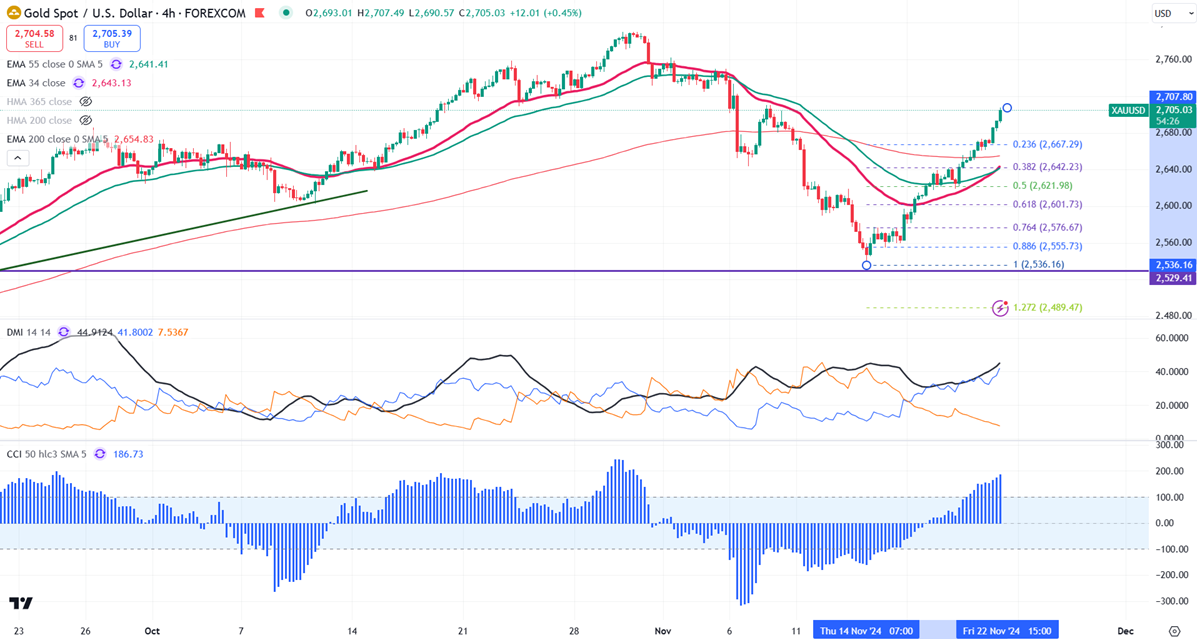

As markets await U.S. flash manufacturing and services PMI for further direction, the technical outlook for gold prices shows them above short-term and long-term moving averages, indicating a bullish trend. Immediate support is at $2,670, with potential declines targeting $2640/$2630, and lower. Resistance sits at $2715; breaking this level could push prices towards $2,750 or $2,767/$2800. A strategy of buying on dips around $2,660 is advised, with a stop-loss at $2,640 and a target price at $2,750.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary