Gold prices surged sharply on easing US treasury yield, hitting a high of $2,635.50.

Strong Demand for Safe-Haven Assets

Gold prices saw a big jump yesterday, rising over 1.3% to exceed $2,620 per ounce. This increase was driven by strong demand for gold as a safe-haven asset due to ongoing conflicts in the Middle East and concerns about economic uncertainty. Additionally, speculation about potential interest rate cuts by the U.S. Federal Reserve has made gold more appealing to investors. Overall, the rise in gold prices reflects a mix of geopolitical tensions and expectations around monetary policy, indicating it may continue to gain in the near future.

Treasury Yield Trends

The yield on the 10-year Treasury note fell to around 4.21%, down from 4.30% earlier in the week, a decrease of about 9 basis points. This drop happened as investors reacted to recent economic data and shifting feelings about interest rates. As signs of an economic slowdown emerge, many investors think the Federal Reserve might keep cutting rates, leading to a higher demand for Treasury bonds as safer investments.

Goldman Sachs’ Optimistic Gold Forecast

Goldman Sachs has reaffirmed its positive outlook on gold, predicting prices could hit $3,000 per ounce by December 2025. Key reasons for this forecast include increasing gold purchases by central banks, who are diversifying their reserves away from the U.S. dollar. Expectations of further interest rate cuts by the Federal Reserve make gold more attractive, as lower rates increase the appeal of non-yielding assets. Additionally, ongoing geopolitical uncertainties are driving more investors toward gold as a safe-haven asset.

ETF Investment Expectations

Goldman also expects that investments in gold exchange-traded funds (ETFs) will rise as the Fed eases policies. Following this outlook, gold prices have rebounded from recent lows and are currently around $2,612 per ounce. Overall, Goldman Sachs’ forecast encourages investors to view gold as a strategic asset given current economic uncertainties and potential inflation.

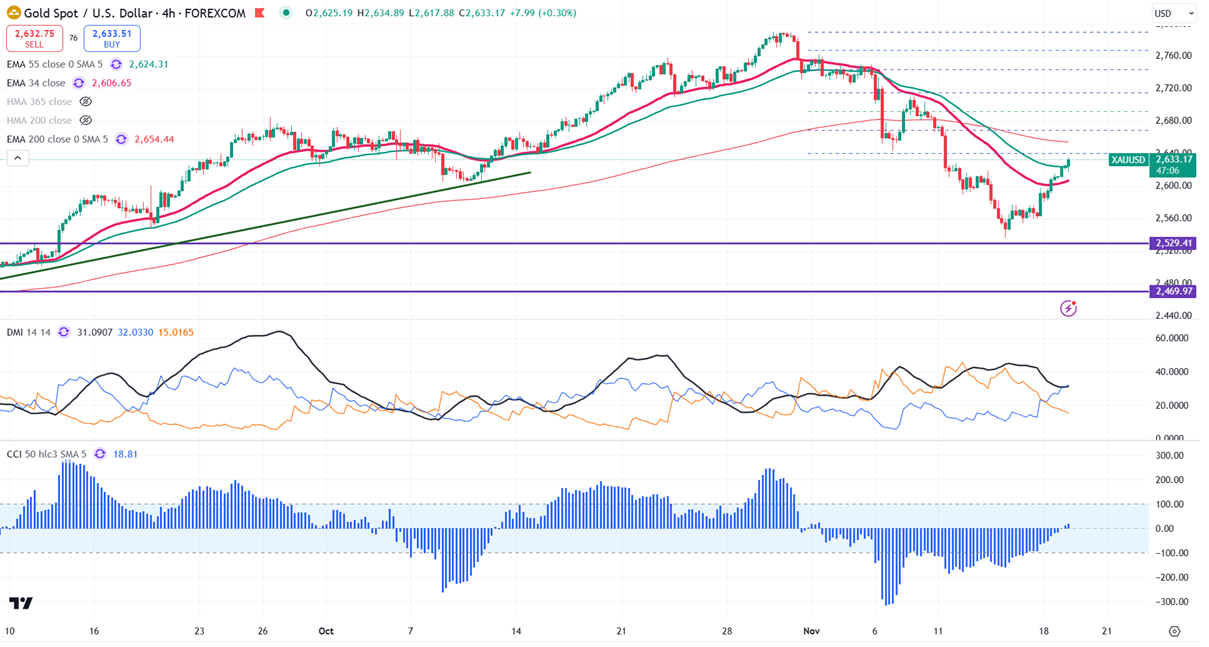

Technical Outlook for Gold Prices

Currently, gold prices are situated above both short-term and long-term moving averages on the 4-hour chart, indicating a bearish trend. Immediate support appears at $2,600; if prices fall below this level, they could target further declines to $2,580, $2,560, $2,535, $2,500, and possibly $2,470. On the upside, minor resistance is noted at $2,635; breaking through this barrier could lead to an upward movement toward $2,665, or even $2,700.

Given the bullish indicators, a strategy of buying on dips around $2,578-$2,580 is recommended, with a stop-loss set at $2,550 and a target price of $2,700.