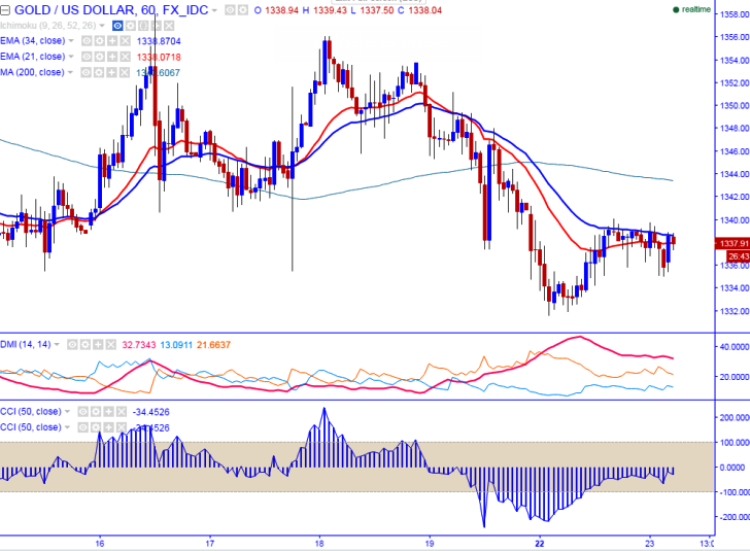

- Major resistance- $1344 (200 HMA and Cloud bottom).

- Major support - $1330 (61.8% retracement of $1311 and $1375.15).

- The yellow metal regained slightly after making a low of $1331.60.It is currently trading around $1338.50.

- In the hourly chart, gold is trading neutral and it should break above $1344 for further upside.

- On the higher side, any violation above $1344 will take the commodity to next level till $1350/$1358 in the short term.

- The major support is around $1330 and any break below will drag the commodity down till $1315/$1308 (38.2% retracement of $1199 and $1375.15).

- Short term weakness only below $1300.

It is good to sell on rallies around $1343-45 with SL around $1358 for the TP of $1330/$1316.