Gold prices hit a fresh all-time high on safe-haven demand. It hit a high of $3976.93 and is currently trading around $3967.93.

Encouraging economic instability and postponing important data releases, the US government shutdown has sparked gold's last price rise by driving investors to safe havens. assets in light of rising political volatility in France and more general market swings. Adding to this, hopes of additional Federal Reserve rate cuts—following a 25-basis-point lowering in September 2025—have undermined the dollar's strength, hence lowering the opportunity cost of holding non-yielding gold and increasing its attraction. With 397 metric tons ($38 billion) in the first half of 2025, record inflows into gold-backed ETFs highlight strong institutional and retail demand. Central Leading banks like China and Russia continue a decades-long buying binge that has almost doubled world reserves, thereby confirming gold's status as a top-tier reserve asset.

Technical Analysis: Key Levels and Trading Strategy

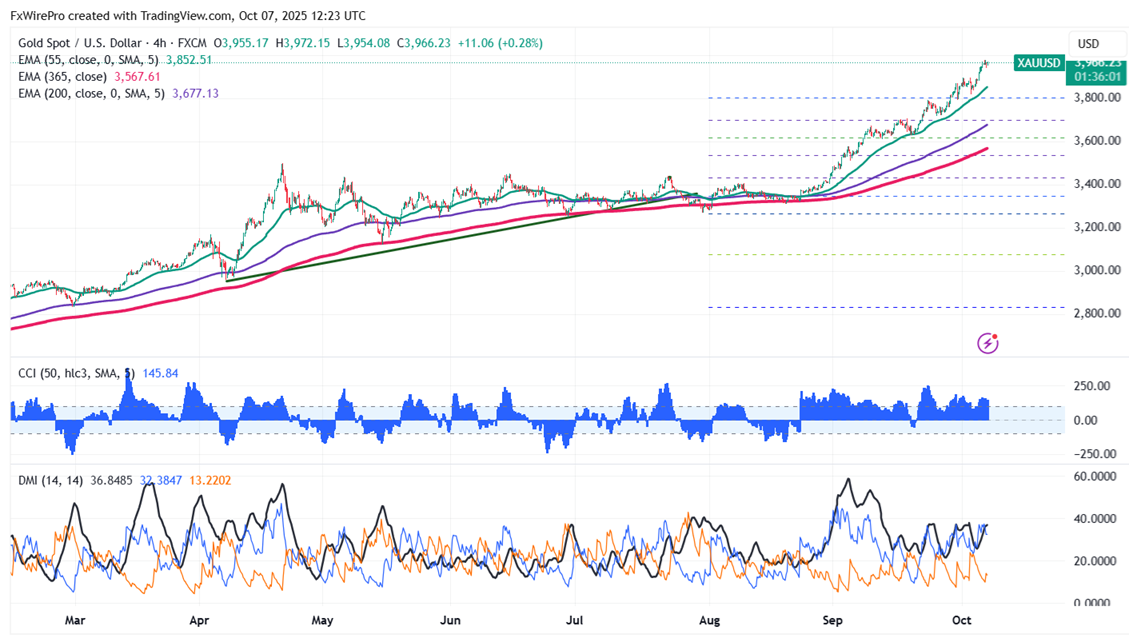

Gold prices are holding above the short-term moving average 34 EMA and 55 EMA) and the long-term moving averages (200 EMA) on the 4-hour chart. Immediate support is at $3925, and a break below this level will drag the yellow metal to $3850/$3800/ $3700/$3675/$3653/$3600. The near-term resistance is at $4000 with potential price targets at $4033/$4100.

It is good to buy on dips around $3800-05 with a stop-loss at $3700 for a target price of $4000/$4100.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings