Gold declined sharply as Trump announced a new tariff. It hit an all-time high of $2954 and is currently trading around $2859.

Economic Backdrop

The US economy expanded 2.3% on an annualized basis during the fourth quarter of 2024, or 0.6% over the previous quarter, validating early estimates but representing a slowdown from the last quarter's 3.1%. The economy was largely driven by household expenditure, up 4.2%, and government spending.

For the week ended February 22, 2025, U.S. initial jobless claims rose to a seasonally adjusted 242,000, higher than economists' forecasts and the highest since early December 2024. This is 22,000 higher than the revised level of the prior week, suggesting potential softening in the labor market and increased layoffs across sectors.

The increase in unemployed claims is evidence of some moderation in the robust U.S. labor market, possibly suggesting rising layoffs and initial economic issues.

Durable Goods Mixed Bag

Total Durable Goods Orders: Rose by 3.1% month-to-month to $286 billion.

Core Durable Goods Orders (excluding defense and transportation): Up 0.8% in January.

Transportation Equipment: Up 9.8% to $96.5 billion.

Excluding Transportation: Orders were essentially unchanged.

Excluding Defense: Orders rose by 3.5%.

Rate Pause Hopes Fade

According to the CME Fed Watch tool, the chances of a rate pause in the Mar 19th, 2025 meeting have decreased to 92.50% up from 94% a week ago.

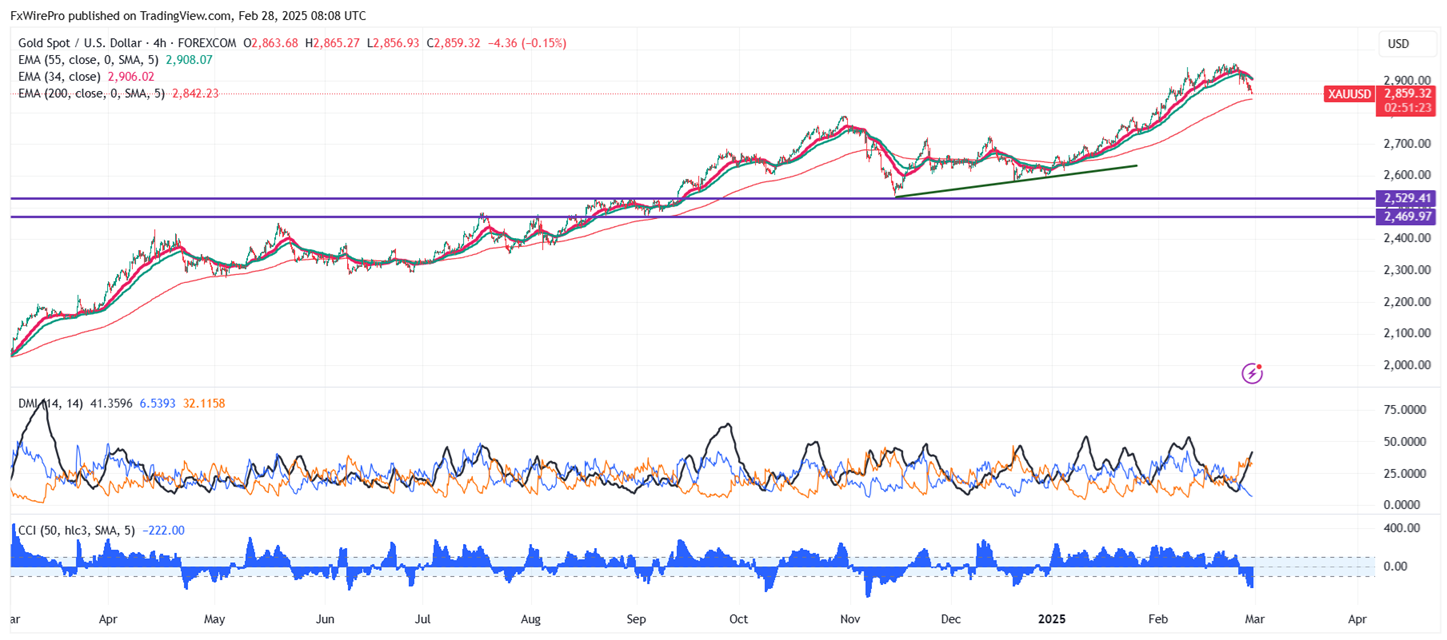

Technical Analysis: Key Levels and Trading Strategy

Gold prices are holding above short-term moving averages of 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4-hour chart. Immediate support is at $2850 and a break below this level will drag the yellow metal to $2830/$2800/$2770/$2740. The near-term resistance is at $2880, with potential price targets at $2900/$2920/ $2940/$2957/$3000.

It is good to buy on dips around $2850 with a stop-loss at $2830 for a target price of $3000.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings