Even after 8 days of consecutive decline, gold bulls are still struggling to find a minimum rhythm to break the bear momentum.

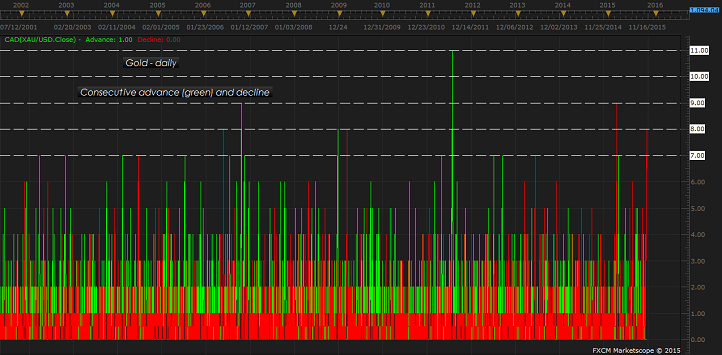

In past decade Gold has declined only three times for eight consecutive days and once for nine consecutive days. In March this year, gold declined for 9 consecutive days and other two back in 2006 and 2009.

This clearly indicate, even though bulls are lacking conviction, sentiment might be extreme suggesting partial profit book and wait for the opportune moment to sell back.

With US Federal Reserve rate hike bets back large and equities rallying, Gold might be clearly out of favor.

Technically speaking, Gold has been moving within a downward sloping channel, which has been in place since 2013. Since Gold got rejected near channel resistance and broken interim support line, it might go for channel floor, which lies around $1050 area.

Given rate hike probability, that targets looks feasible.

Gold is currently trading at $1094/troy ounce, up 0.45% today so far.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary