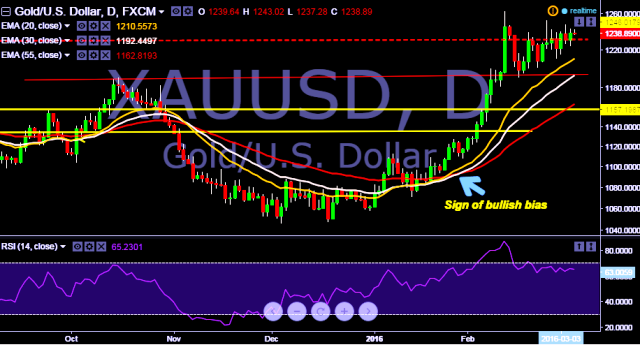

- Pair is currently hovering around $1240 levels.

- It made intraday high at $1243 and low at $1237 levels.

- Yesterday US released ADP job data with positive numbers at 214K m/m vs 193K m/m previous release.

- In addition, today China's Caixin Services Purchasing Managers' Index (PMI) fell from a six-month high of 52.4 in January to 51.2 in February.

- Intraday bias remains bullish for the moment.

- On the top side key resistance seen at $1248/$1252 levels.

- Initial support levels are seen at $1224/$1215 thereafter.

- Later today US will publish ISM non manufacturing data as well as factory order. This will provide further direction to the parity.

We prefer to take long position in XAU/USD around $1235, stop loss $1224 and target $1248/1268 thereafter.