Gold recovers from low of $1160, market awaits U.S jobs report for further direction.

Friday, December 2, 2016 6:18 AM UTC

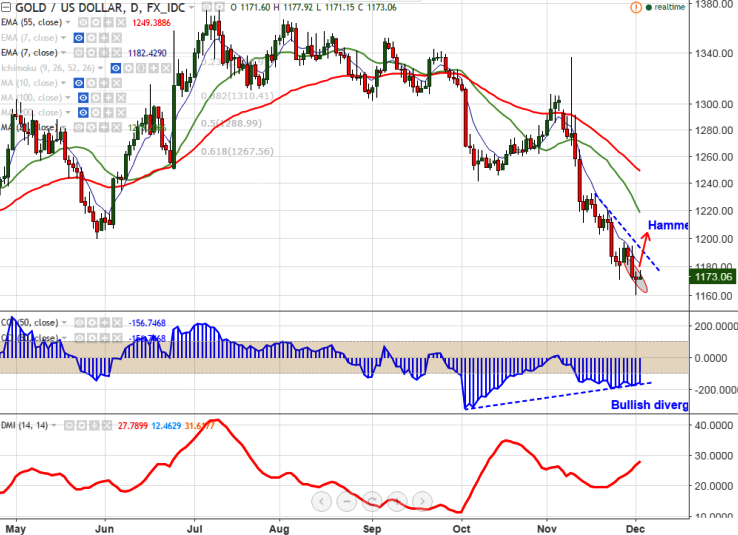

- Candlestick pattern – hammer

- Pattern formed- Bullish divergence (CCI (50)

- Gold made a fresh 10 –month low of $1160 yesterday and jumped slightly from that level. It is currently trading around 1175.

- Market awaits U.S NFP data today for further direction. U.S economy is expected to add 177k jobs in the month of Nov compared to 161k in previous month. Only an dismal U.S jobs report will prevent the Fed from hiking rates.

- The yellow metal‘s upside is capped by 7- day EMA ($1185) and any break above targets $1200.Any indicative break above $1200 targets $1210 (23.6% retracement of $1337 and $1171.07)/$1221.

- On the lower side, any break below $1160 will drag the commodity down till $1147/$1130 level.

- In the daily chart gold has formed bullish divergence and hammer pattern. So a slight jump till $1185 cannot be ruled out.

It is good to buy on dips around $1170-$1172 with SL around $1160 for the TP of $1185/$1194