The yellow metal traded higher on Wednesday, as the demand safe heaven assets increased after US stocks opened lower.

- As of now commodity has decline strongly after finding resistance at 1206 in the mid US session, and currently is approaching to test support level located at 1234.

- Further downside is expected to be limited as the support level located at 1206 is likely to hold the bears from falling further below and bring a rebound back towards higher levels.

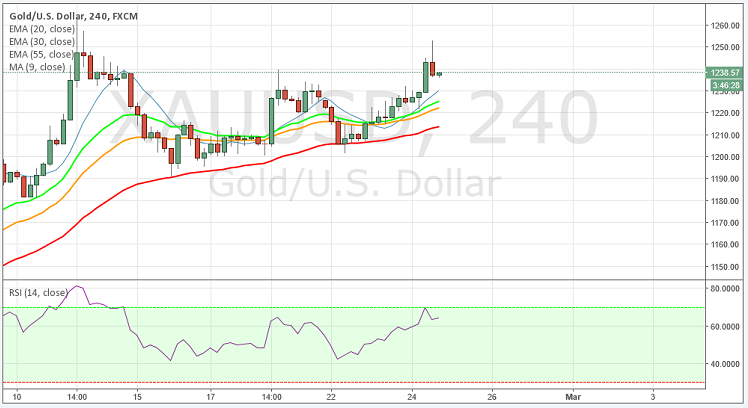

- Technically in the 4 hour chart the 55, 30 and 20 MA slowly turning up, whistle the RSI is in positive territory at 58.

- To the upside, the strong resistance can be seen 1246, a break above this level would expose the commodity towards 1254 levels.

- To the downside immediate support can be seen at 1236, a break below at this level will open the door towards 1219 levels.

Recommendation: Go long around 1210, targets around 1240/1270, SL 1198

Support levels: S1-1236, S2-1219, S3-1206

Resistance levels: R1-1246, R2-1254, R3-1270